Beyond Meat issued a profit warning this morning. It’s trading down 14% today and down about 60% from its all-time high. Beyond Meat sells plant-based “meat” foods such as burgers, sausages, and chicken tenders amount other products. I only had one of their burgers and that was enough for me. I’m not a huge meat eater and limit my intake just because I find it hard to digest.

The profit warning today was unique as they blamed just about everything but the obvious. Management believes demand was impacted by broader ongoing macro and micro-economic factors, including among others, the effects of the COVID-19 Delta variant. Oh really? This was taken in March 2020 during the COVID crisis.

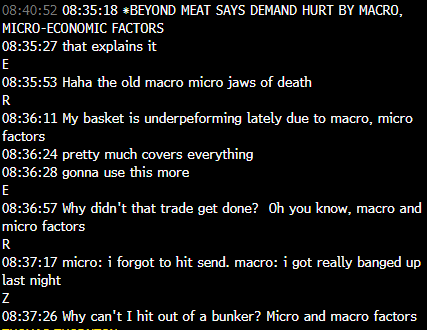

In one of my Bloomberg chatrooms, this was a trader conversation that really made me laugh.

The company also experienced a decrease in retail orders that persisted longer than expected from a Canadian distributor coinciding with the reopening of restaurants, expected incremental orders that did not materialize from a change in a distributor servicing one of the company’s large customers, observed delays in distribution expansion and shelf resets believed to be driven by customer labor shortages, and incurred shortfalls at certain U.S. foodservice customers believed to be driven by the effects of the COVID-19 Delta variant.

The excuses continued as they blamed “severe weather, water shortages AND water damage” too. The company further experienced challenges in operations that led to unfulfilled orders, with severe weather as a key driver resulting in the loss of potable water for two weeks in one Pennsylvania facility and water damage to inventory in another.

The truth of why they really guided down is people don’t think Beyond Meat’s products are delicious.

I am not short BYND this time as I’ve had a few nice wins on the short side and I do expect this to continue lower. Although I would not short it today.

The markets today have a couple of narratives happening. First, Snapchat and Intel reported terrible earnings, and second, Fed Chairman Powell was speaking today and he sounded very hawkish with comments about the coming QE taper and traders perceived his comments as him admitting inflation is not as transitory as he’s stated in the past, therefore, actual rate hikes could start sooner. One subscriber in our Bloomberg chat suggested Powell was hawkish as he knows he might not be renominated. Jim Bianco was on Bloomberg earlier and he thought Powell’s renomination might be a bargaining chip between the moderate and far-left Democrats with the big and much delayed Biden stimulus. Plausible.

This combination of weak tech earnings and Powell’s hawkishness has hit the mega-cap stocks down the most. The MAGA custom index with MSFT, AAPL, GOOGL, AMZN is down 2.5% today. Rates are backing off today which isn’t helping tech. Yesterday’s concerns with rates spiking hit financials and other value sectors and that was strange as they tend to be beneficiaries of higher rates. It might be that the Treasury yield curve flattened.

Next week is a big pinnacle week with corporate earnings with the mega cap tech naturally the focus again.

trade ideas

As mentioned earlier on First Call, I covered SNAP for a 17.2% gain. I’m holding on to current shorts and longs. I do expect next week could be the end of this recent bounce.