TOP EVENTS AND CATALYSTS

The week ahead will have a lot of macro catalysts. This includes the OPEC+ meeting Wednesday, the ECB meeting minutes Thursday, the OBR’s preliminary forecasts in the UK Friday, and the US jobs report finishing the week on Friday. It will be another very busy week of central bank speakers, with Fed officials slated to make comments daily.

Investors will be watching to see how the situation in Ukraine evolves as Kyiv marches forward and recaptures territory now claimed by Putin. UK Prime Minister Truss is sticking with her policies after a speech in which she said the tax cuts were the finance minister’s idea.

Only a handful of earnings reports are scheduled, including Wednesday premarket: LW; Thursday premarket: CAG, MKC, STZ; and Thursday postmarket: LEVI. We need to keep an eye out for more negative earnings preannouncements given how many firms have already trimmed their outlooks; it’s likely more will follow.

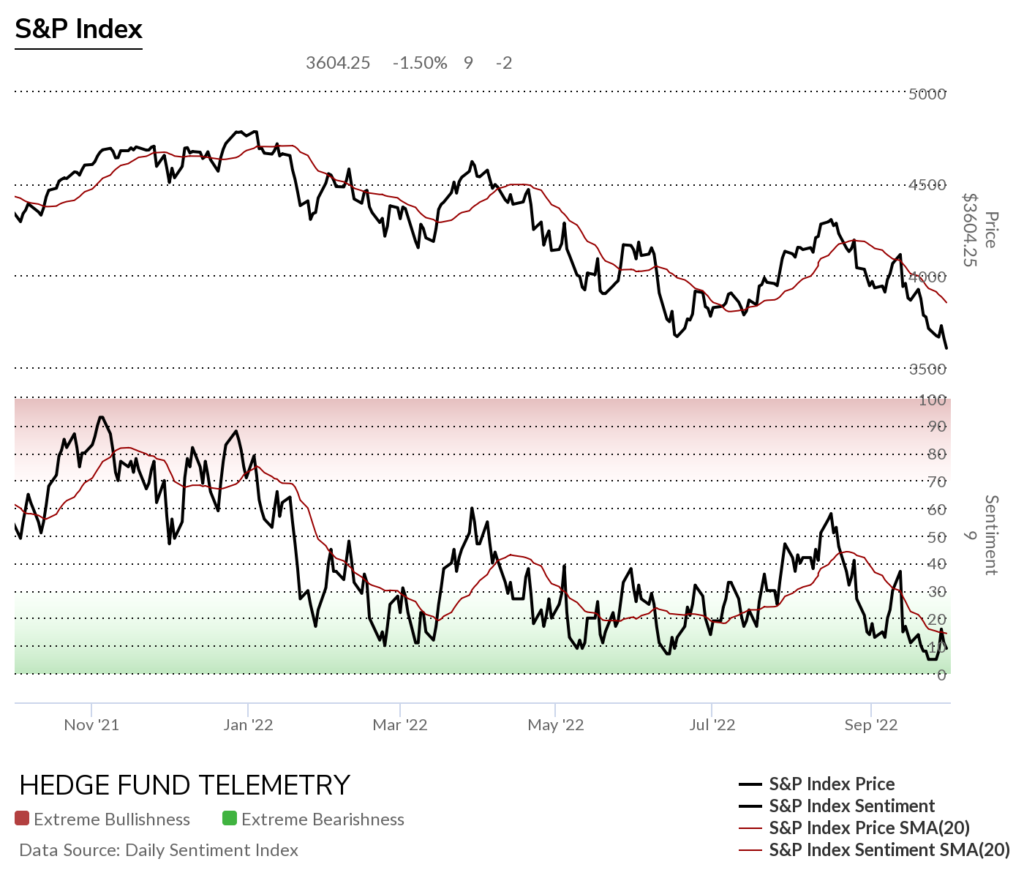

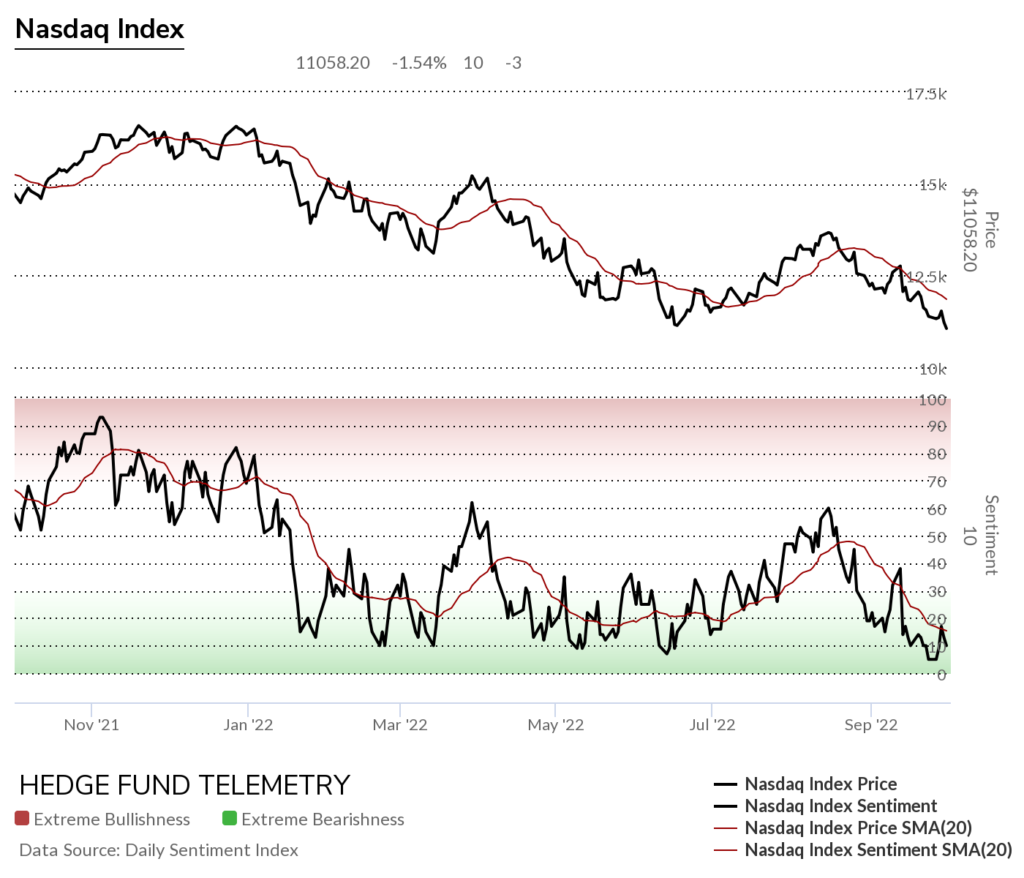

With the market indexes hitting new lows, which has not been unexpected since we still need to get the DeMark exhaustion signals which could occur early this week. Sentiment and internals are deeply oversold at levels seen at significant lows. Still, a significant cash percentage is warranted, while shorting from these levels has a poor risk-reward.

Us market indexes – update

S&P futures have DeMark Sequential and Combo buy Countdowns on day 11 of 13.

S&P cash index daily is now on day 12 of 13, with both Sequential and Combo countdowns

Same with SPY daily

NDX Index with Sequential 13 from Thursday with Combo now on day 11 of 13

QQQ daily with Sequential 13 from Friday with Combo on day 12 of 13

a big week for US economic data

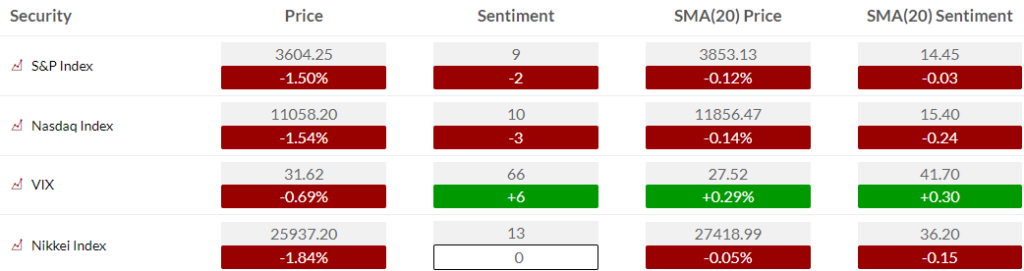

KEY MARKET SENTIMENT

Equity bullish sentiment continues in the deep oversold zone, although sentiment did not make a new low on Friday as the indexes did make new lows.

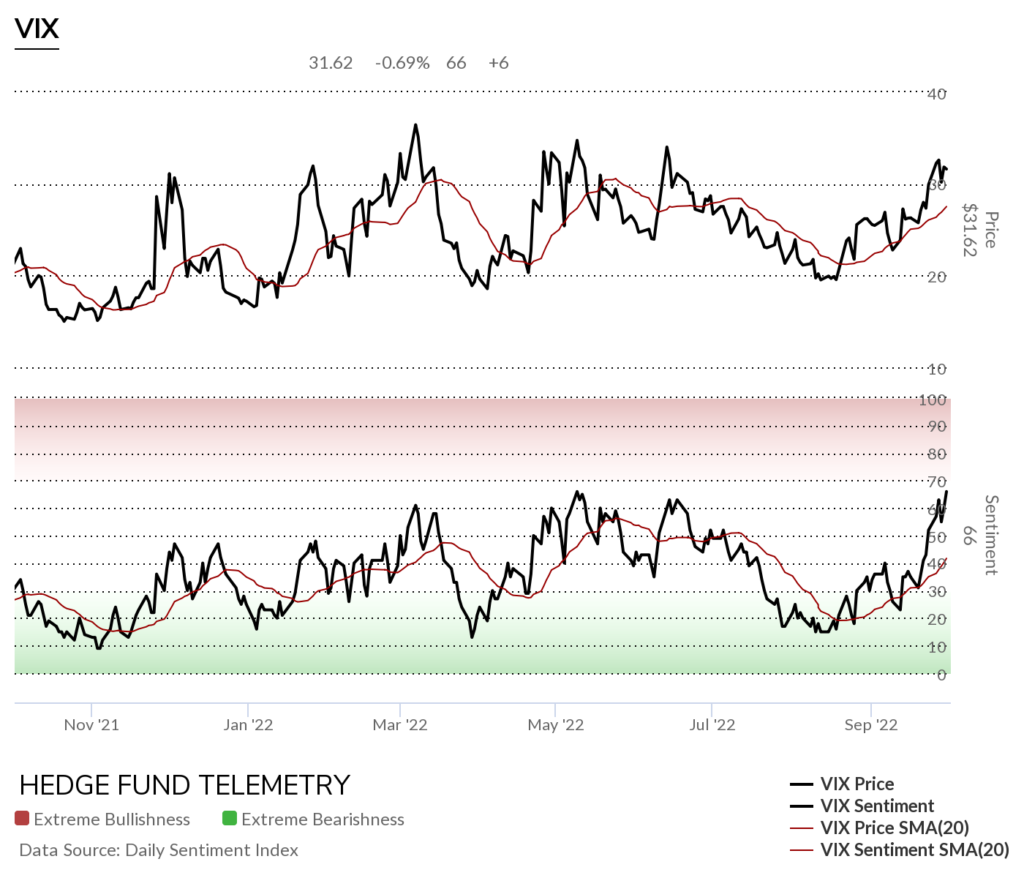

VIX bullish sentiment did make a new one-year high

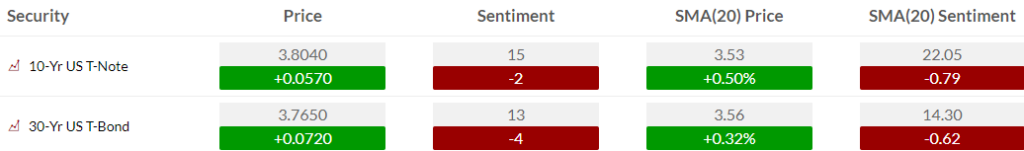

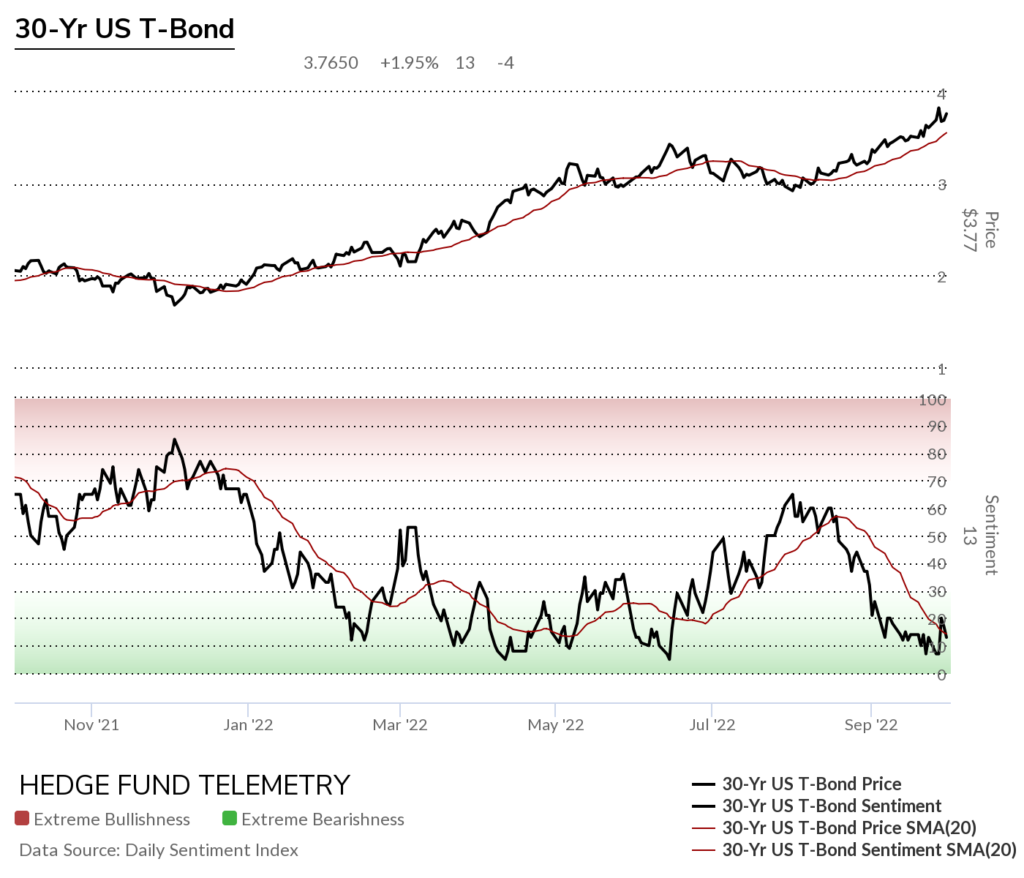

Bond bullish sentiment also remains in the deep oversold zone

Currency bullish sentiment with US Dollar bullish sentiment off highs however remaining in the extreme zone

Bitcoin bullish sentiment remains unchanged in the oversold zone

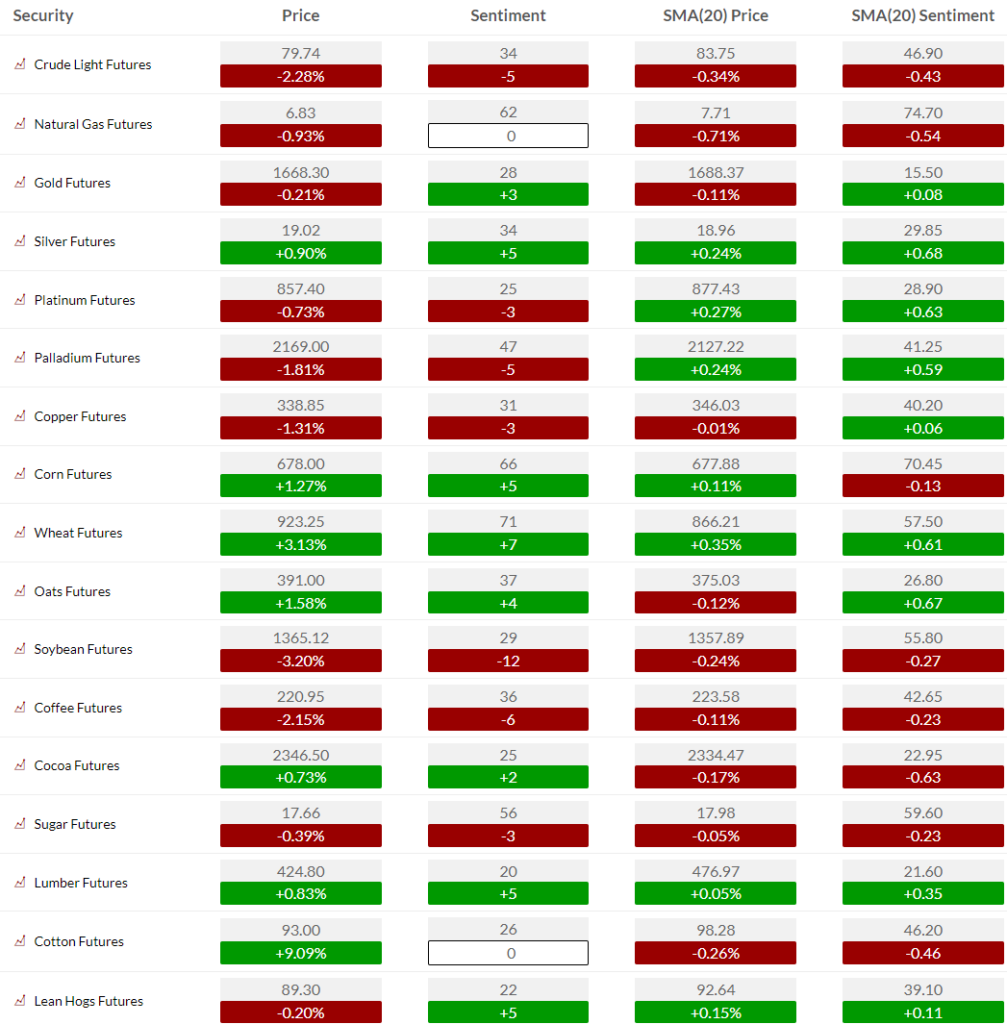

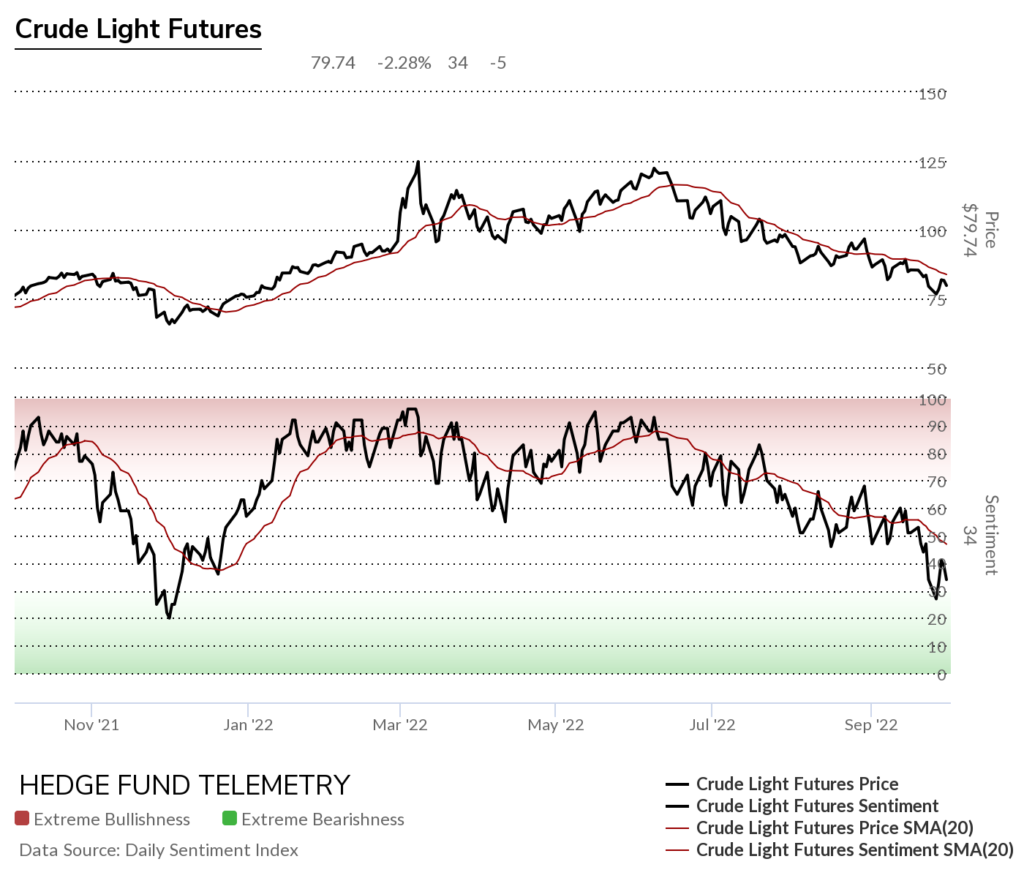

Commodity bullish sentiment was mixed all week

Crude futures now has the 20 day moving average of sentiment under 50% for the first time since late last year

EARNINGS, CONFERENCES, AND ECONOMIC REPORTS

- Monday 03-Oct:

- Corporate:

- Analyst/Shareholder Events: AURA, CCEL, DHHC, ILMN, KSCP, LEGN, RNA, SBGI

- Brokerage Conference:

- Berenberg Invitational

- Chardan Genetic Medicines Conference

- UBS Future of Electric Mobility Virtual Conference

- Bank of America Precision Oncology Conference

- Reuters IMPACT

- RBC CDMO Healthcare Conference

- Economist Impact – Sustainability Week: Countdown to COP27

- Credit Suisse Sustainability Week

- Economic

- US: Manufacturing PMI, Construction Spending, ISM Manufacturing Index

- Europe: CPI y/y, Manufacturing PMI, SVME PMI

- Corporate:

- Tuesday 04-Oct:

- Corporate:

- Earnings:

- Pre-open: AYI

- Post-close: SAR, SGH

- Analyst/Shareholder Events: AEP, CIR, HAS, KSCP, MBTC, PALI, RELL, TTD, XSPA

- Brokerage Conference:

- Reuters IMPACT

- RBC CDMO Healthcare Conference

- Economist Impact – Sustainability Week: Countdown to COP27

- Credit Suisse Sustainability Week

- WOOD EME NYC Conference

- Stifel: ESG Panel: Finding Strategic Solutions That have Strong Sustainability Bona Fides

- Raymond James – Sustainability Conference

- World Ocean Tech and Innovation Summit

- The Finest CEElection Investor Conference

- Earnings:

- Economic

- US: JOLTS, Factory Orders, Redbook Chain Store, API Crude Inventories

- Europe: Unemployment Change, PPI y/y

- Asia: CPI y/y

- Corporate:

- Wednesday 05-Oct:

- Corporate:

- Earnings:

- Pre-open: BYRN, HELE, LW, RPM

- Post-close: RELL, RGP

- Analyst/Shareholder Events: AI, AVAV, AYTU, HCP

- Brokerage Conference:

- Economist Impact – Sustainability Week: Countdown to COP27

- Credit Suisse Sustainability Week

- World Ocean Tech and Innovation Summit

- The Finest CEElection Investor Conference

- Scaling Blended Finance for Climate Solution Investment in Emerging Markets

- Private Equity International Investor Relations, Marketing & Communications Forum

- BMO Capital Markets Canadian High Yield Conference

- Earnings:

- Economic

- US: MBA Mortgage Purchase Applications, ADP Employment Report, Trade Balance, Services PMI, ISM Non-Manufacturing Index, DOE Crude Inventories, Building Permits (Canada)

- Europe: Trade Balance, Industrial Production m/m, Services PMI, GDP y/y, Unemployment Rate

- Asia: Retail Sales Nominal NSA Y/Y

- Corporate:

- Thursday 06-Oct:

- Corporate:

- Earnings:

- Pre-open: ANGO, CAG, LNDC, MKC, STZ

- Post-close: ACCD, AEHR, IDT, LEVI

- Analyst/Shareholder Events: BOX, CEAD, ESTC, GWRE, NCLH, NEOG, NUVA, PALI, SDGR, STAR, TMX

- Brokerage Conference:

- Economist Impact – Sustainability Week: Countdown to COP27

- Credit Suisse Sustainability Week

- Private Equity International Investor Relations, Marketing & Communications Forum

- BMO Capital Markets Canadian High Yield Conference

- 121 Mining Investment New York Conference

- Cantor Neurology & Psychiatry Conference

- Roth Healthcare Opportunities Conference

- PDUFA: 4147.TT (Trogarzo), ALNY (OXLUMO)

- Earnings:

- Economic

- US: Challenger Job Cuts, Weekly Jobless Claims, EIA Natural Gas Inventories, Ivey PMI (Canada)

- Europe: CPI y/y, Industrial Production m/m, Factory Orders m/m, Manufacturing Turnover (sa) m/m, Construction PMI, Retail Sales y/y

- Corporate:

- Friday 07-Oct:

- Corporate:

- Earnings:

- Pre-open: TLRY

- Analyst/Shareholder Events: APO, FIZZ, IEA, LIXT, RPM, U, VALU

- Brokerage Conference:

- Credit Suisse Sustainability Week

- Earnings:

- Economic

- US: Nonfarm Payrolls, Unemployment Rate, Average Weekly Hours, Average Hourly Earnings, Consumer Credit, Employment (Canada)

- Europe: Unemployment rate (sa), Manufacturing Production (s.a.) m/m, Industrial Production m/m, Halifax House Prices y/y, Retail Sales y/y, Trade Balance

- Asia: Caixin Services PMI

- Corporate:

Thanks to Street Account, Vital Knowledge, and Bloomberg as valued sources.