TOP EVENTS AND CATALYSTS

This week’s key macro events include the Bank of Canada decision on Wednesday morning, the US Beige Book on Wednesday afternoon, and the October flash PMIs on Thursday morning.

The busiest week for Q3 US earnings include: Monday postmarket: NUE, SAP, ZION; Tuesday premarket: DGX, DHR, FCX, FI, GE, GM, KMB, LMT, MCO, MMM, NSC, PHM, RTX, SHW, VZ; Tuesday premarket: BKR, CSGP, ENPH, PKG, STX, TXN; Wednesday premarket: APH, BA, GD, GEV, HLT, KO, T, VRT; Wednesday postmarket: ALGN, IBM, KNX, LRCX, LVS, MAT, NOW, ORLY, TER, TMUS, TSLA, URI, WHR; Thursday premarket: AAL, CARR, DOW, HAS, HON, LH, LUV, MSM, NOC, SPGI, TSCO, UNP, UPS, VLO; Thursday postmarket: COF, DXCM, EW, LHX, RMD, SKX, WDC; and Friday premarket: AN, AON, CL, CNC, HCA, SAIA.

EU earnings include: Tuesday morning: Intercontinental; Tuesday night: L’Oreal; Wednesday morning: Akzo Nobel, Assa Abloy, Deutsche Bank, Heineken, Lloyds Banking Group, Reckitt Benckiser, WPP; Wednesday night: Carrefour, Kering; Thursday morning: Anglo American, Barclays, Danone, Hermes, Unilever; and Friday morning: Electrolux, Mercedes, Sanofi.

On Monday, I will put out a post with all the relevant major earnings previews. The currency and Commodity weekly notes are done and just need formatting before sending. Our new subscriber Slack channel is up and running. If you’re interested, please send us an email.

Weekend News

- There is a tentative settlement of the Boeing strike (a deal between the aerospace giant and its union was reached Saturday, and a union vote will take place Wednesday). Ending the strike would be positive for Boeing and our new long BA position.

- Hezbollah launches drone attack near Netanyahu’s holiday home in a move Israel called an assassination attempt Reuters

- Israel preparing military strike on Iran according to leaked US intelligence documents NYT

- Polls suggest this is the closest election in recent memory (a “coin flip”, “literally 50/50”) NBC News

- Humana and Cigna – the two firms are once again holding takeout talks (albeit “informal” ones) after negotiations for CI to buy HUM fell apart last year. Bloomberg

- Elon Musk announced a $1 Million Lotto-Style Giveaway to registered voters in Pennsylvania and other swing states who sign his PAC’s petition.

Charts we are watching

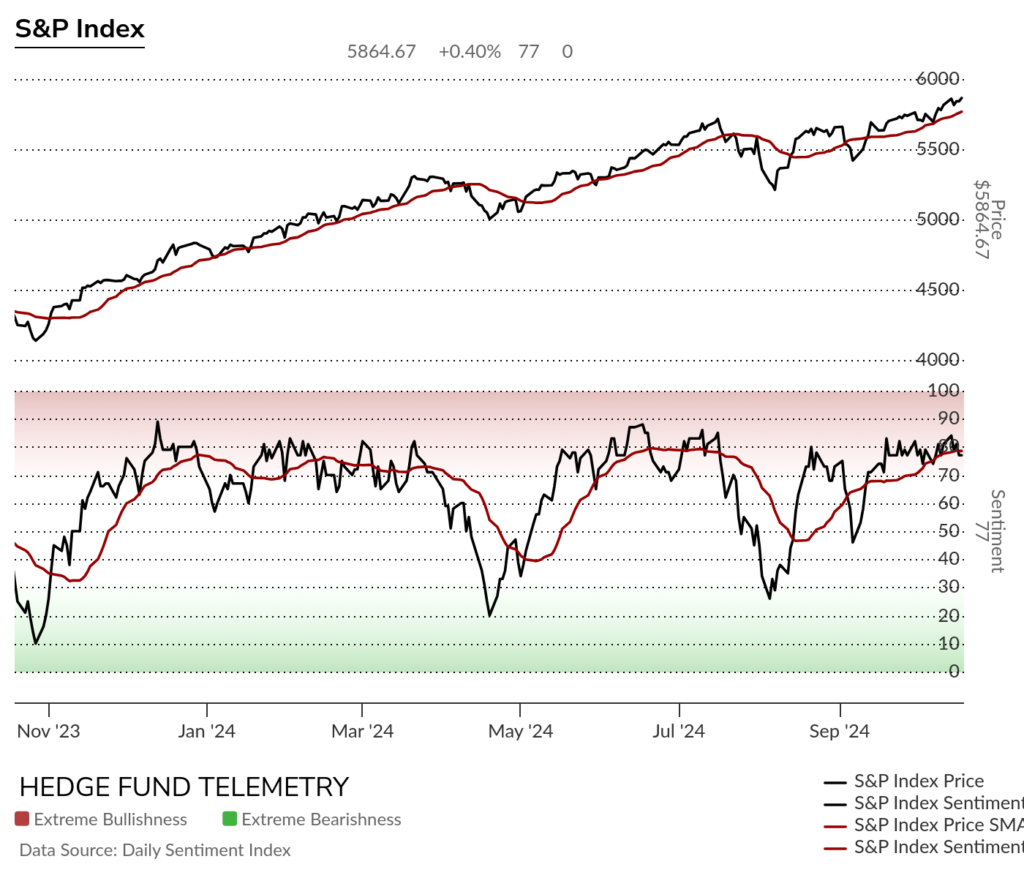

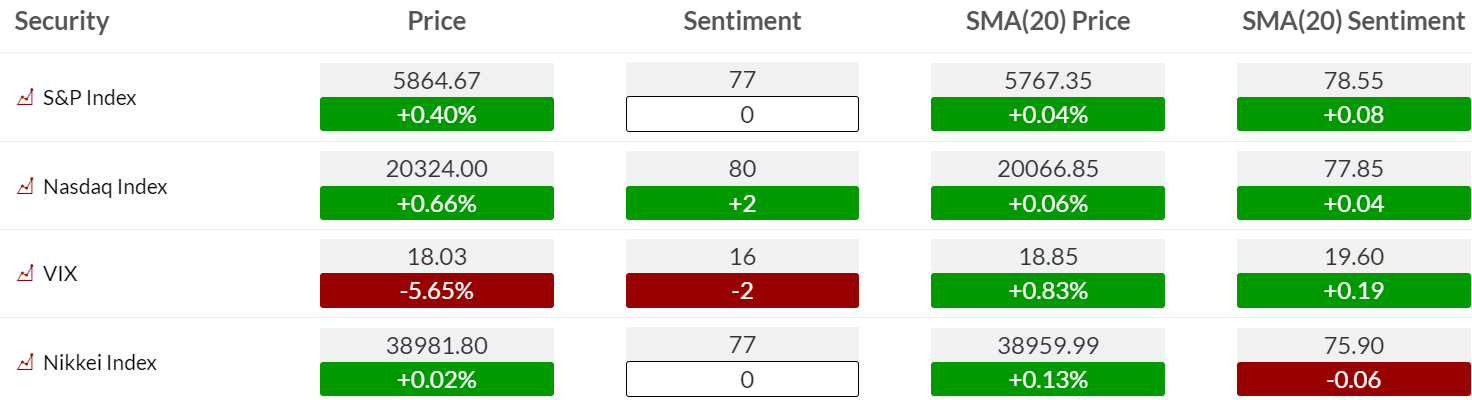

With the election a few weeks away, the markets have been pricing in a Trump victory, according to many market pundits. It remains a tight race and will have market implications for whoever wins. I’ve discussed how the setup for Trump 2.0 vs Trump 1.0 with the economic setup differences, with my biggest concern with the US Debt at $21 trillion in 2016 and over $35 trillion today ignored by both candidates. Looking at things objectively, I can see that the technical and sentiment setup differs notably from that in 2016 and today. It’s overbought today vs 2016 when data was oversold. S&P bullish sentiment at 77% is elevated with the 20 day moving average of bullish sentiment (red line) overbought.

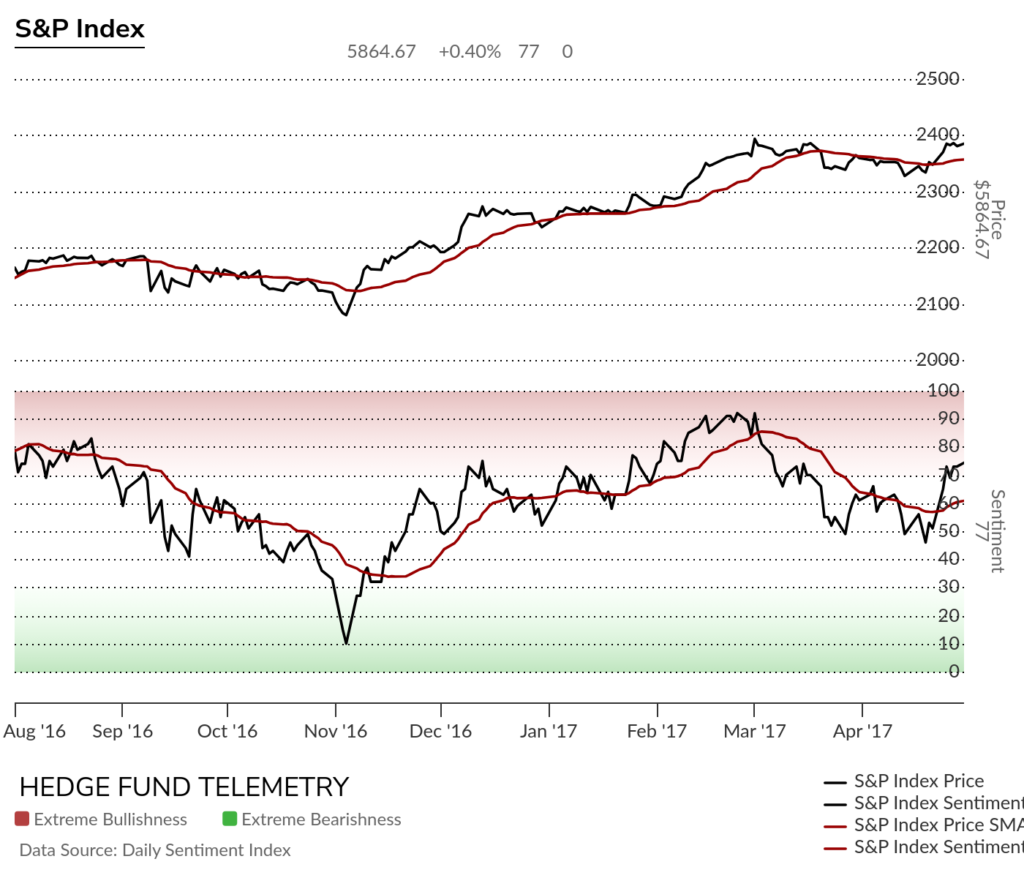

This is the S&P bullish sentiment in 2016 heading into the election, dropping, with bullish sentiment hitting 10% – very oversold on election day. You can adjust dates on our site with sentiment.

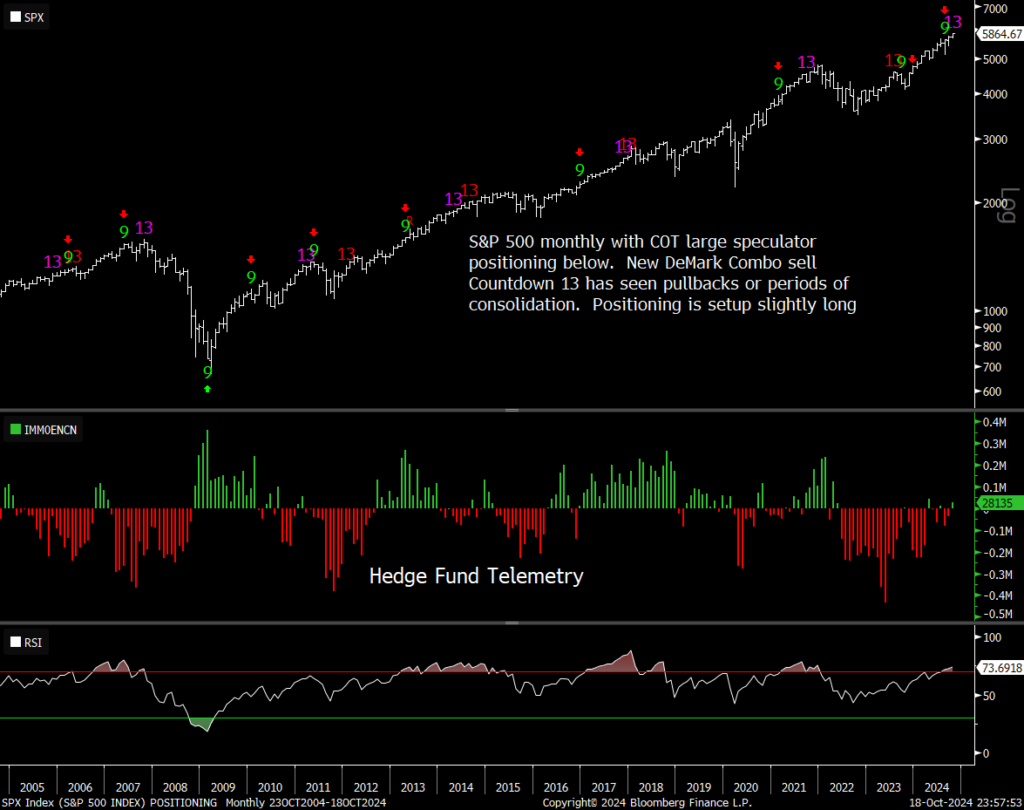

Currently the S&P Index remains in extended wave 5 of 5 with recent Sequential and Combo sell Countdown 13’s and new Sell Setup 9. There is a secondary Sequential on day 8 of 13.

Heading into the 2016 election, the markets topped in August with a DeMark Sequential sell Countdown 13. A move lower with a buy Setup 9 at the 200 day marked the oversold low.

Today’s Dow Jones Industrial Average has a new Combo sell Countdown 13 while the secondary Sequential is on day 9 of 13 and sell Setup 9 possible on Monday with a close over the 5th green bar close.

I remember showing this back in 2016 the Dow had trended lower into the election and had a DeMark buy Countdown 13 at the lows.

The Nasdaq 100 led the markets higher and still has not surpassed the July highs while there are current Sequential and Combo sell Countdown 13’s in play.

The current Russell 2000 Index setup has the potential for the Sequential to continue higher on day 9 of 13. It’s been a rather choppy pattern from the summer, to say the least.

The S&P monthly chart shows a few things to note. Heading into the 2016 election the index moved in a sideways consolidation for nearly 2 years after DeMark sell Countdown 13’s. There is a new Combo 13 triggered this month. Other Combo 13’s have seen tops and consolidation periods. The large speculator COT days has seen the heavy short positioning from the last few year now turn back to positive again. Other positioning data sets have shown the positioning setup even more bullish. In 2016 positioning turned from bullish to bearish ahead of the election that gave short term reversal momentum swing combined with the shorter-term downside exhaustion signals shown above.

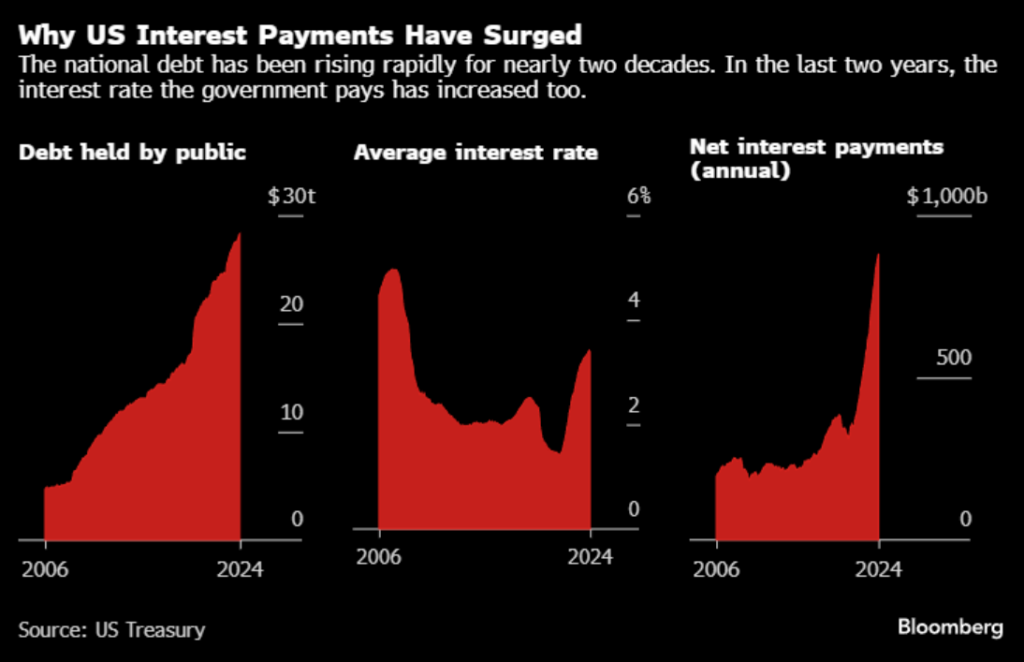

Debt levels – not an election talking poinT

My biggest problem with both candidates is their lack of concern with out-of-control spending and debt/deficit levels. Both continue to promise more spending while differing on tax proposals. This is an issue that has bi-partisan responsibility shared.

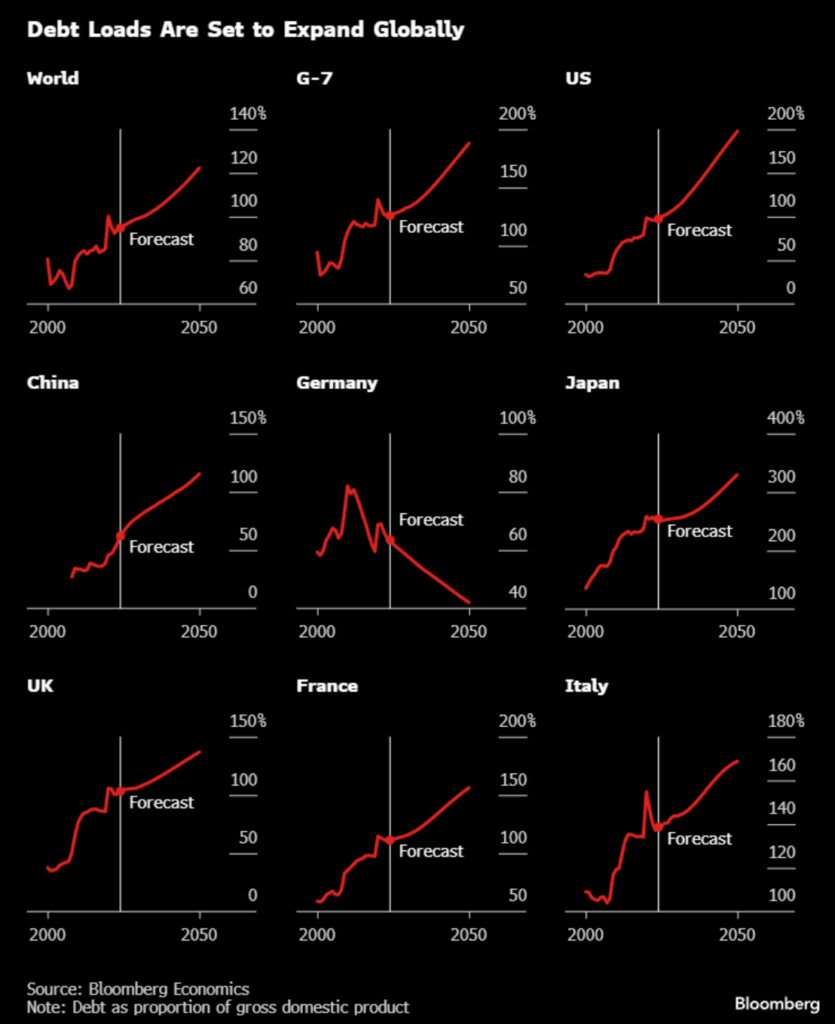

Debt-to-GDP forecasts are set to increase globally except for Germany. If there is a major economic recession and GDP goes negative, it will be an even worse problem. Nobody seems to acknowledge this possibility.

US economic data for the week

KEY MARKET SENTIMENT

Equity bullish sentiment remains elevated and extreme at 77%/80%, with the 20-day moving average of bullish sentiment at 78%—a very extended level.

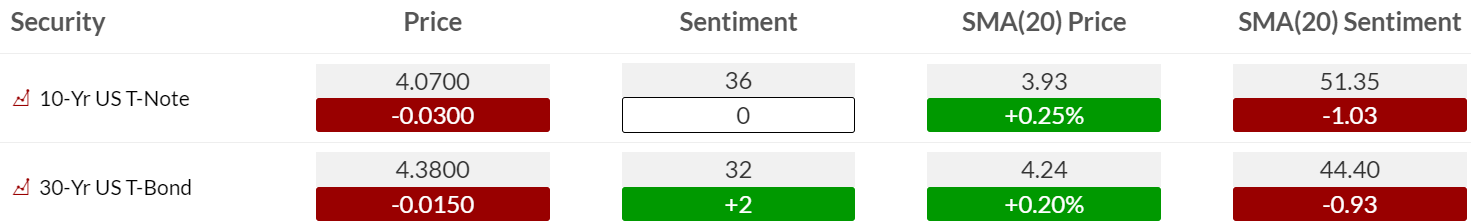

Bond bullish sentiment was little changed at 32%.

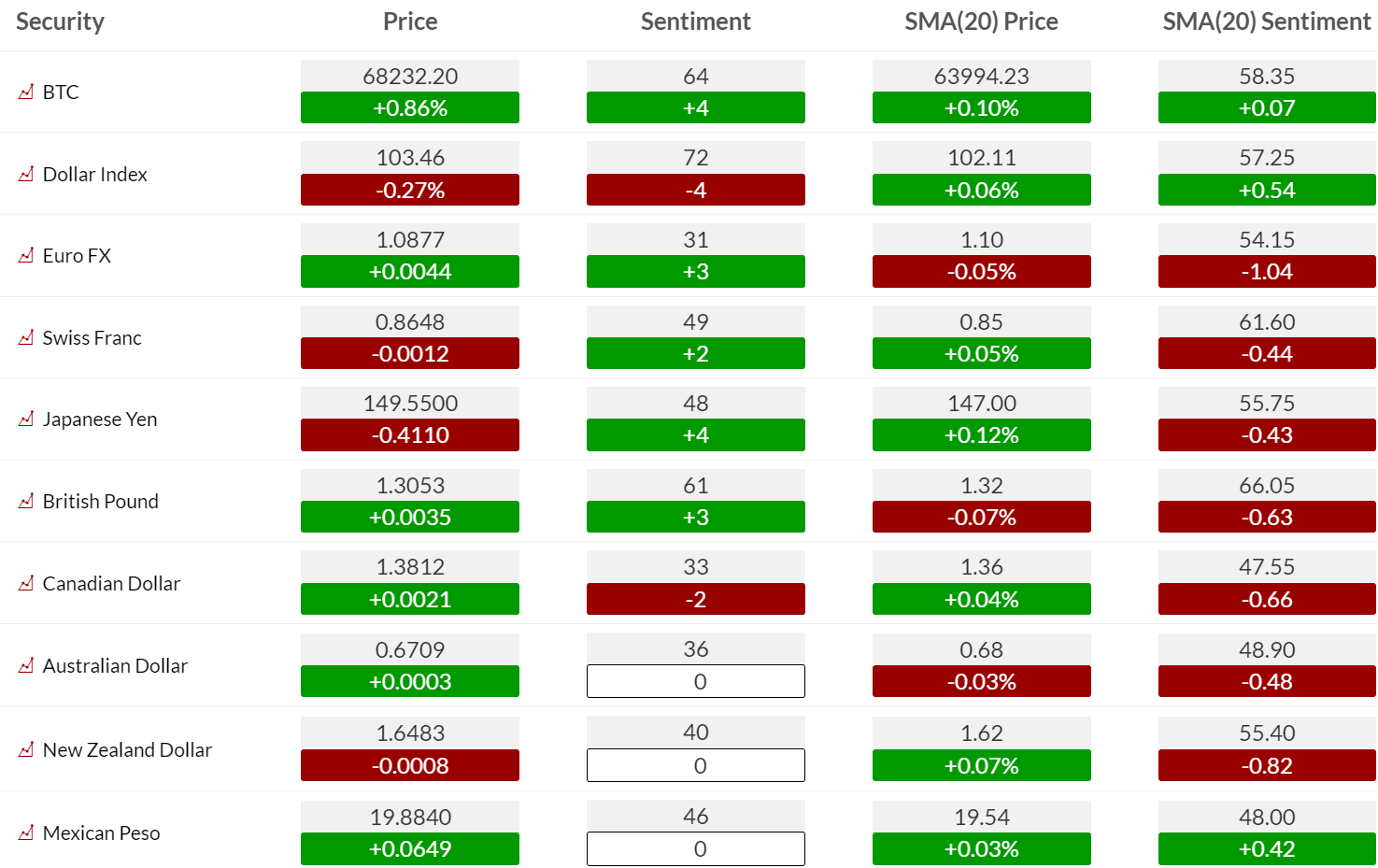

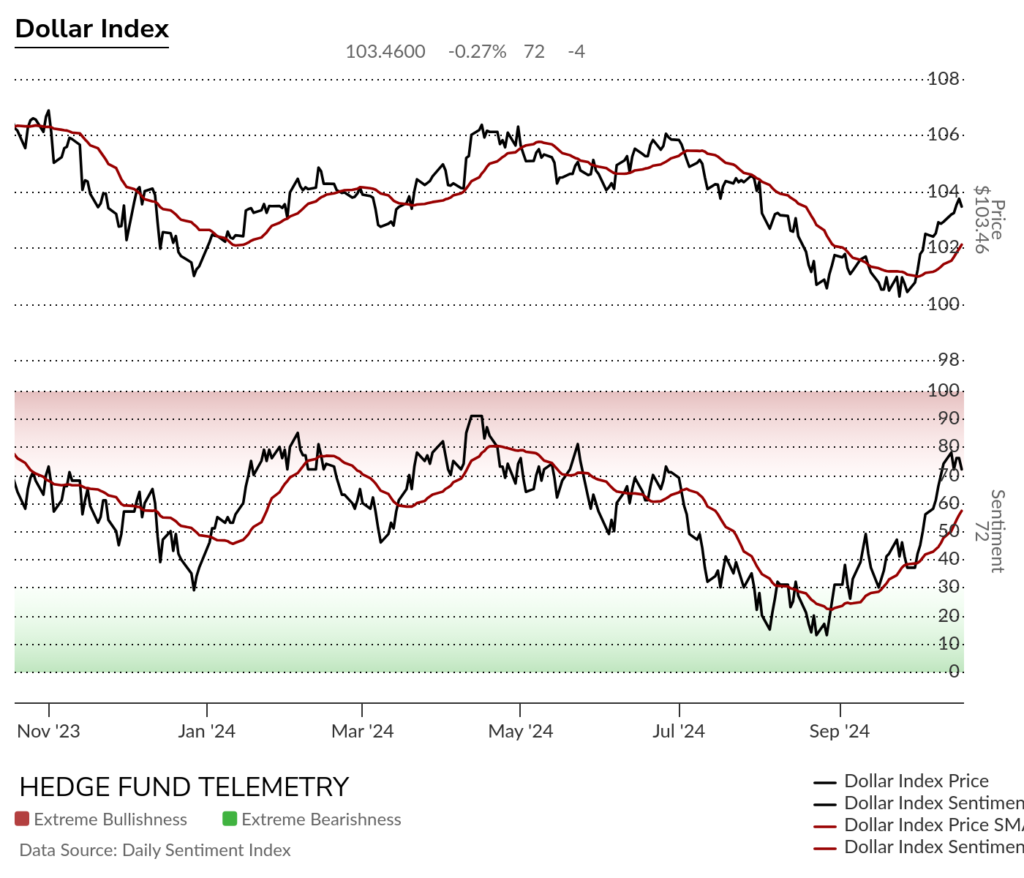

Currency bullish sentiment with US Dollar bullish sentiment backing off while remaining in the elevated zone.

The US Dollar bullish sentiment pulled back from nearly hitting the extreme zone. The move from 13% a multi year low has been strong. Some consolidation is probable.

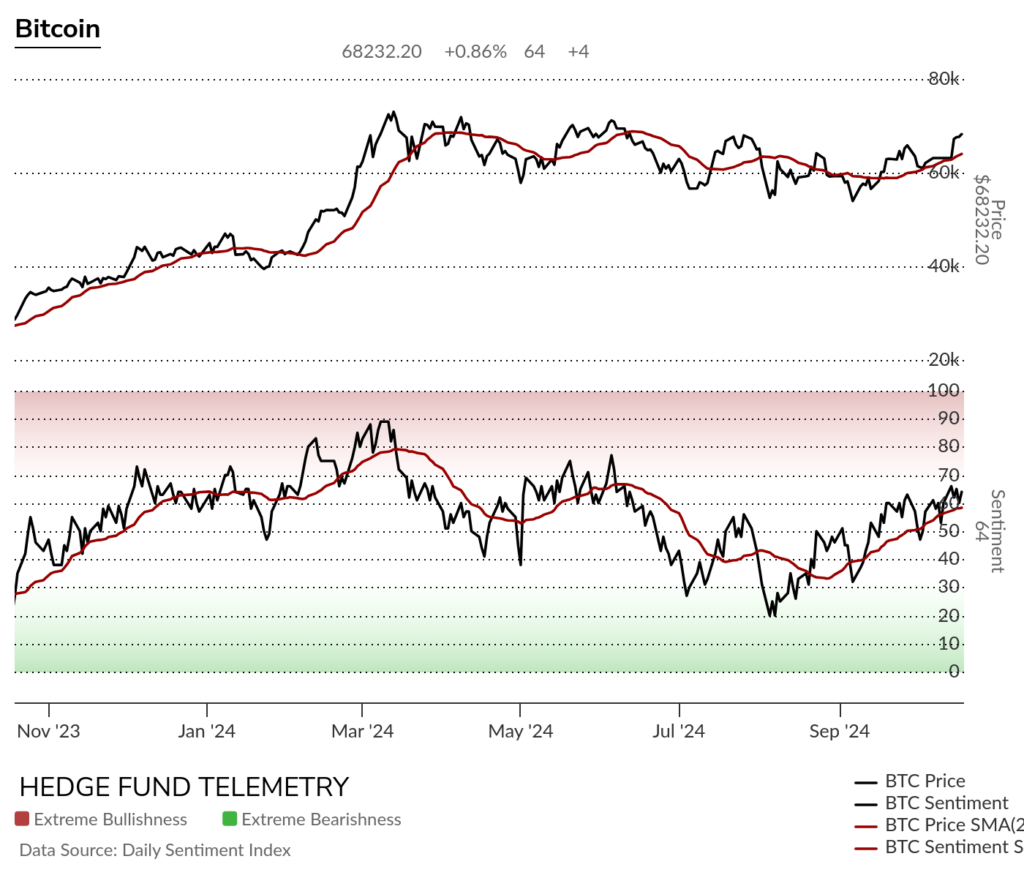

Bitcoin bullish sentiment has been making higher lows on pullbacks and is not yet into the elevated zone where pullbacks have occurred.

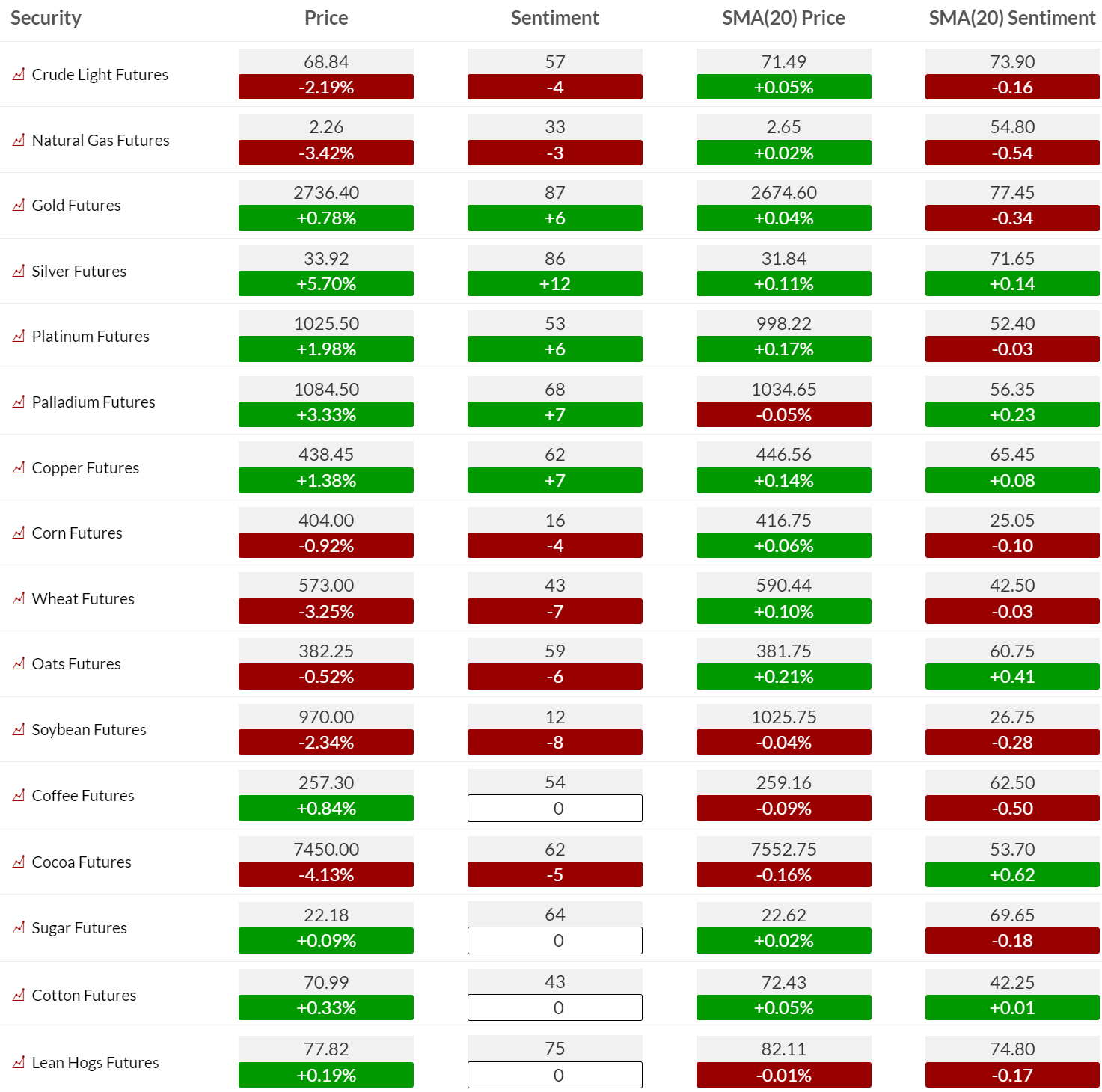

Commodity bullish sentiment had energy sentiment decline while metals saw large increases back into the extreme zone for Gold and Silver.

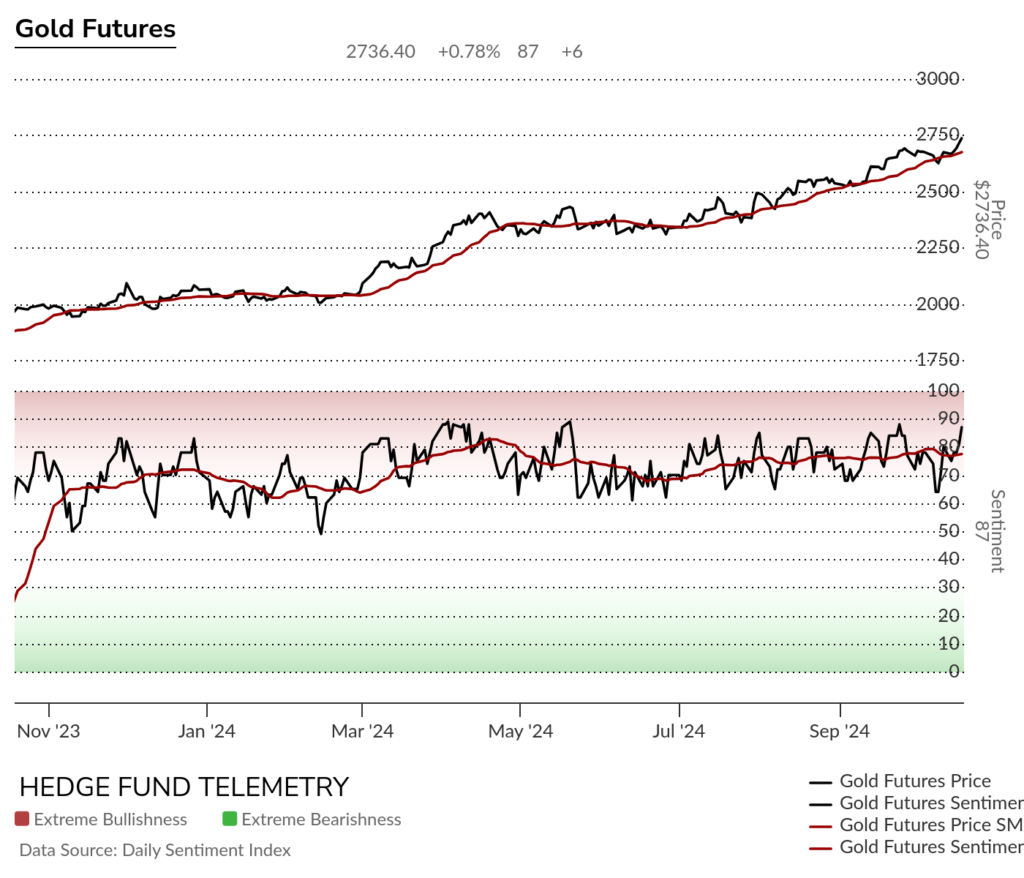

Gold bullish sentiment continues to hold the low end of the range ~60% seen all year. It’s back into the upper end of the extreme zone at 87%. Until the low end of the range breaks, pullbacks will remain nominal and can be bought.

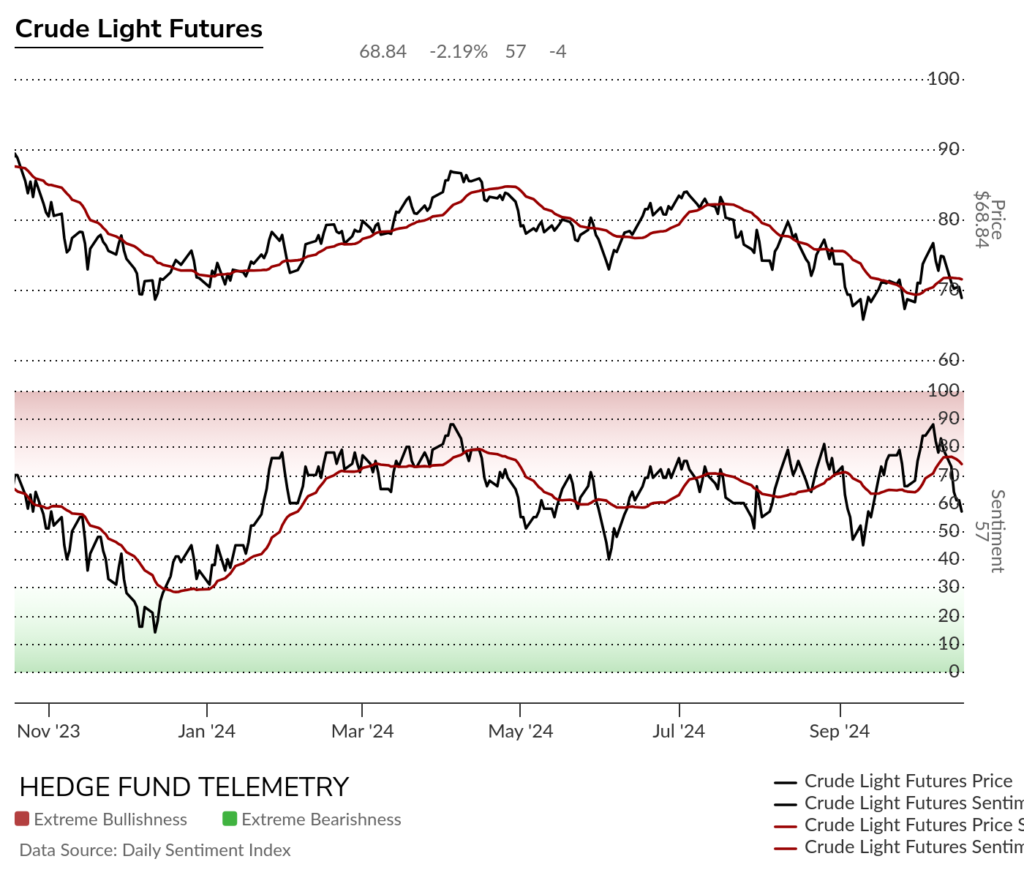

Crude bullish sentiment recently hit 88%, which I described as a limiting factor despite the price being significantly below the Summer highs. It’s pulled back and could find support at 50% again. Sentiment has remained relatively stronger, which I would attest to the conflict and risks in the Middle East.

EARNINGS, CONFERENCES, AND ECONOMIC REPORTS

- Monday 21-Oct:

- Corporate:

- Earnings:

- Pre-open: AJX, DX, GNTY, KSPI, MNSB, PFBC, SASR

- Post-close: AGNC, ARE, BOKF, CADE, CATY, EFSC, ELS, ESRT, FLXS, HSTM, HXL, KREF, LU, MEDP, MTAL, NUE, PAC, RBB, RLI, SFBS, SIGI, SMBK, SSD, TRST, WASH, WRB, WTFC, ZION

- Analyst/Investor Events: JEF, VTSI

- Brokerage Conference:

- American Academy Of Ophthalmology Meeting

- Human Proteome Organization World Congress

- 121 Mining Investment Conference

- Electricity Transformation Canada 2024

- BioProcess International Asia

- Snapdragon Summit

- PDUFA: CAMX.SS (CAM2029)

- Earnings:

- Economic

- US: Leading Indicators

- Europe: PPI y/y

- Corporate:

- Tuesday 22-Oct:

- Corporate:

- Earnings:

- Pre-open: AOS, AUB, BANC, BKU, CBU, DCOM, DENN, DGX, DHR, FCX, FI, GATX, GE, GM, GPC, HRI, IPG, IVZ, KMB, LMT, MCO, MMM, NSC, ONB, PCAR, PEBO, PHM, PII, PM, PNR, RTX, SHW, SIFY, VZ

- Post-close: ADC, AGR, BDN, BKR, CSGP, ENPH, ENVA, EWBC, HAFC, HIW, JBT, LRN, MANH, MTDR, NBHC, NBR, NTB, PFSI, PKG, PMT, RHI, RNST, ROIC, RRC, STX, TRMK, TXN, USNA, VBTX, VICR, VLRS, VMI

- Analyst/Investor Events: MKC

- Syndicate: +HUHU IPO (~$6M)

- Brokerage Conference:

- Human Proteome Organization World Congress

- 121 Mining Investment Conference

- Electricity Transformation Canada 2024

- BioProcess International Asia

- Snapdragon Summit

- Jefferies Private Technology Conference

- European Society of Gene & Cell Therapy Meeting

- Earnings:

- Economic

- US: Philly Fed Pres Harker Speaking Engagement, Redbook Chain Store, API Crude Inventories

- Corporate:

- Wednesday 23-Oct:

- Corporate:

- Earnings:

- Pre-open: APH, AVY, BA, BLFY, BPOP, BSX, BXMT, CME, COOP, CSTM, EVR, FBP, GD, GEV, HCSG, HLT, KBR, KO, LAD, LII, MMYT, NEP, NTRS, ODFL, PB, PRG, ROP, SF, T, TCBX, TDY, TMHC, TMO, TNL, TRU, UCB, UNF, VRT, WAB, WFRD, WGO, WSO

- Post-close: ALGN, AMP, AMSF, AMTB, ASGN, BELFB, BRKL, BWB, CACI, CASH, CBAN, CCS, CHDN, CLB, CVLG, CYH, EGBN, EGP, EPRT, EQC, FAF, FRBA, GBX, GGG, GL, GTY, HBNC, HLX, IBM, ICLR, INBK, KALU, KNX, LC, LOB, LRCX, LVS, MAT, MC, MOH, MORN, MSA, MXL, NEM, NEU, NLY, NOW, OBK, OII, ORLY, PEGA, PI, PLXS, PTEN, QCRH, QS, RBBN, RJF, ROL, SEIC, SLM, SLP, SPFI, SSB, STC, TER, TMUS, TSLA, TYL, URI, UVSP, VKTX, VLTO, WCN, WH, WHR, WSBC, WU

- Analyst/Investor Events: N/A

- Syndicate: +GELS IPO (~$6M); +LBGJ IPO (~$9M)

- Brokerage Conference:

- Human Proteome Organization World Congress

- Electricity Transformation Canada 2024

- BioProcess International Asia

- Snapdragon Summit

- Jefferies Private Technology Conference

- European Society of Gene & Cell Therapy Meeting

- American Society of Nephrology Kidney Week

- Earnings:

- Economic

- US: MBA Mortgage Purchase Applications, Existing Home Sales; Fed Gov Bowman Speaking Engagement, DOE Crude Inventories

- Canada: Interest Rate Announcement

- Europe: Flash Consumer Confidence

- Asia: CPI NSA Y/Y, Preliminary GDP y/y

- Corporate:

- Thursday 24-Oct:

- Corporate:

- Earnings:

- Pre-open: AAL, AB, AIT, ALLE, AMAL, AMBP, BC, BFH, BHLB, CARR, CBRE, CNOB, CNX, COLB, CRS, DGICA, DOV, DOW, DTE, EEFT, FCN, FCNCA, FRME, FTI, GTX, HAS, HFWA, HOG, HON, IBCP, ITGR, KDP, KRNY, LADR, LEA, LH, LKQ, LNN, LTH, LUV, LVWR, MPX, MSM, MTLS, NDAQ, NOC, NTCT, ORI, OSIS, POOL, PPBI, R, RDUS, RES, RS, SAH, SBSI, SHYF, SMPL, SPGI, TAL, TPH, TSCO, TXT, UNP, UPS, VC, VIRT, VLO, VLY, WEX, WNC, WST, WTBA, XPRO

- Post-close: ABCB, AJG, ALEX, APPF, ASB, ATR, BFST, BRFH, BWMX, BY, BYD, BYON, CINF, COF, COUR, CSL, CTO, CUZ, DAIO, DECK, DLR, DXCM, EBC, EW, EXPO, FBIZ, FFBC, FFIC, FHI, FIBK, FINW, FISI, GBCI, GLPI, GSIT, HIG, HTH, KN, KNSL, LHX, MGRC, MHK, MOFG, MTX, MYFW, NOV, OLN, ORC, PDM, PECO, PFG, RMD, ROG, SAM, SBCF, SBFG, SKX, SPSC, SSNC, TBBK, TROX, TV, TXRH, UHS, ULH, UVE, VRSN, WDC, WKC, WSFS, WY, ZYXI

- Analyst/Investor Events: BYON, ERAS

- Syndicate: +INGM IPO (~$400M)

- Brokerage Conference:

- Human Proteome Organization World Congress

- European Society of Gene & Cell Therapy Meeting

- American Society of Nephrology Kidney Week

- Kinvestor Virtual Conference

- American College of Allergy, Asthma & Immunology Meeting

- Earnings:

- Economic

- US: Manufacturing/Services PMI, New Home Sales, Weekly Jobless Claims, EIA Natural Gas Inventories

- Europe: Manufacturing Business Climate, Business Survey

- Asia: CPI Tokyo y/y

- Corporate:

- Friday 25-Oct:

- Corporate:

- Earnings:

- Pre-open: AN, AON, AVTR, B, BAH, BCPC, CL, CNC, DOC, FHB, GNTX, HCA, KOF, NWL, NYCB, PIPR, POR, SAIA, STEL, SXT, TNET, VRTS, WT

- Post-close: VALE

- Analyst/Investor Events: SENS

- Brokerage Conference:

- European Society of Gene & Cell Therapy Meeting

- American Society of Nephrology Kidney Week

- American College of Allergy, Asthma & Immunology Meeting

- PDUFA: PFE (sulopenem)

- Earnings:

- Economic

- US: Durable Orders, Michigan Consumer Sentiment (Final)

- Canada: Retail sales

- Europe: PPI y/y, Retail Sales y/y, Consumer Confidence, Business Confidence, M3 Money Supply y/y, IFO Business Climate

- Asia: Manufacturing Production NSA Y/Y

- Corporate:

Thanks to Street Account, Vital Knowledge, and Bloomberg as valued sources.