TOP EVENTS AND CATALYSTS

The week ahead is a holiday week in the US, with Thanksgiving on Thursday with a half day on Friday. I will have one note on Wednesday morning and one on Friday. I wish everyone’s family a very happy Thanksgiving. We have a few updates coming that I am excited about with new note formats and a new proprietary indicator that will be used for equity index trading. We expect 4-6 on average trades per month, both long and short, per ETF. I developed this momentum indicator this year and have tested it and see the potential. I’ve shared some of the details of the note formats with some subscribers, and they are as excited as I am to get these rolled out next Monday.

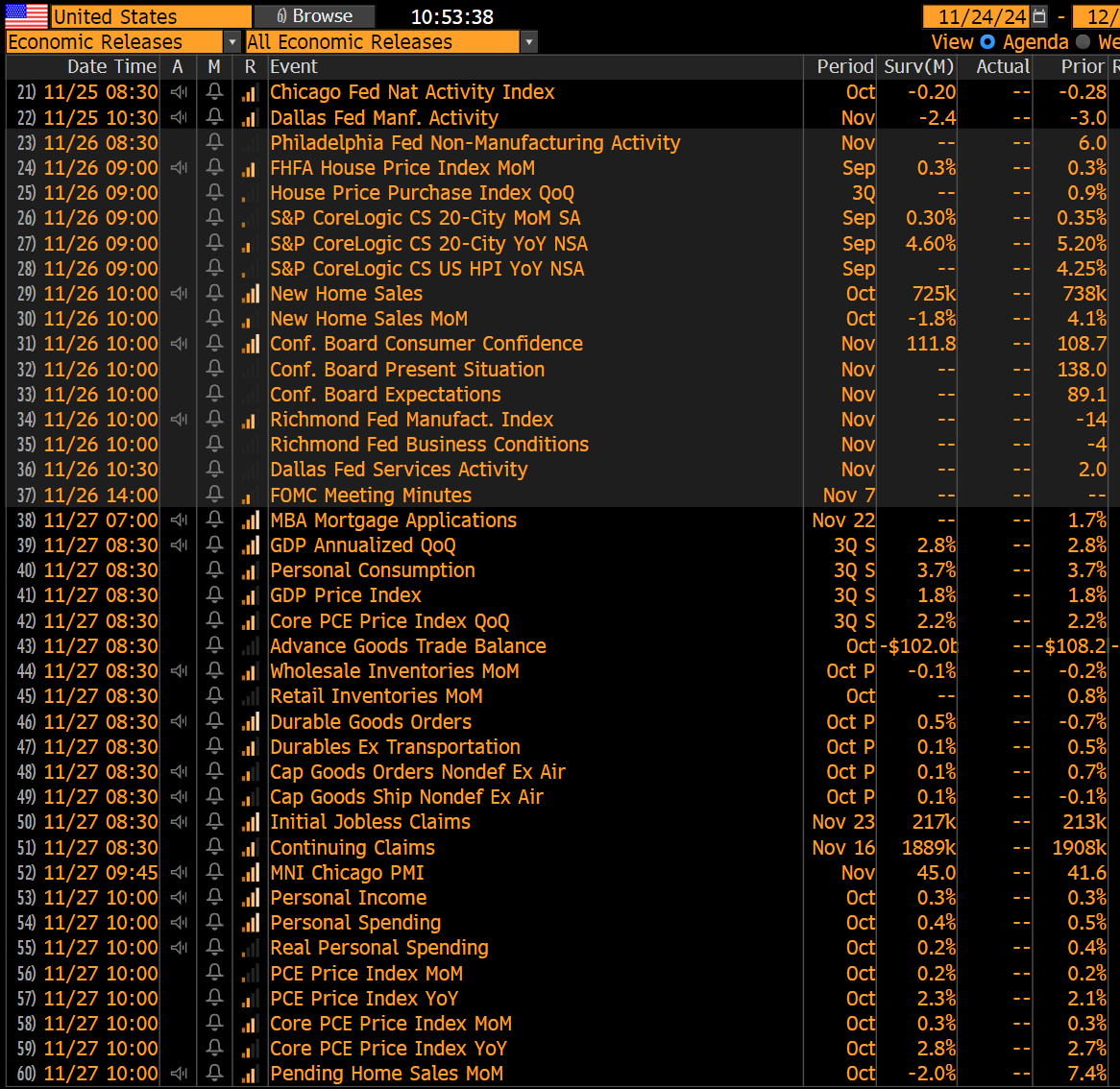

The main macro events this week include the FOMC meeting minutes on Tuesday at 2 pm ET, the US PCE for October on Wednesday morning, Japan’s Tokyo CPI for November on Thursday night, the Eurozone CPI for November on Friday morning, and China’s NBS PMIs for November Friday night.

The October US PCE (a little stale and dated) is expected to accelerate on both headline (+2.3% vs. +2.1% in September) and core (+2.8% vs. +2.7% in September), providing further data for the Fed to leave rates on hold at the December 18th meeting. However, the November jobs report on December 6th will likely not concern the Fed, barring any outlier data. Tokyo’s CPI is seen accelerating on both headline (+2.2% vs. +1.8% in October) and core (+1.9% vs. +1.8% in October), reinforcing expectations for the BOJ to hike rates at its December meeting. The Eurozone CPI is forecast to accelerate on both headline (+2.3% vs. +2% in October) and core (+2.8% vs. +2.7% in October), which could complicate expectations for an aggressive ECB rate cut on December 12th (Europe’s data has been quite stagflationary of late – something that recall Powell at his last press conference stumbled a bit when asked if the Fed was prepared for stagflation in the US. China’s economic data has been decent lately as the government’s stimulus initiatives start to bear fruit, and investors anticipate this pattern will repeat itself with the November PMIs.

The key earnings reports this week include: Monday premarket: BBWI; Monday postmarket: A, ZM; Tuesday premarket: ADI, ANF, BBY, DKS, KSS, M, SJM; and Tuesday postmarket: ADSK, CRWD, DELL, GES, HPQ, JWN, URBN, WDAY.

weekend News

- Trump Friday night confirmed Scott Bessent as his Treasury Secretary nominee, ending weeks of speculation. The final three picks were all considered market-friendly (vs Lutnick), so it’s unclear how much this will matter on Monday. Bessent is a solid pick, and knowing him personally and nearly going to work for him at Key Square, I only have high regard for him; however, he has a monumental task with huge Treasury refunding in 2025 with a higher rates backdrop. Let alone working for Trump and pushing the tariff plan on foreign countries.

- Republicans may try to change budget rules so that simply extending the existing Trump tax cuts won’t cost anything as far as Congressional calculations are concerned, although markets won’t fall for this – Treasuries appreciate that extending the cuts will have a huge impact on deficits and the debt and Congress would be remiss to ignore the bond vigilantes sitting at the negotiating table NYT

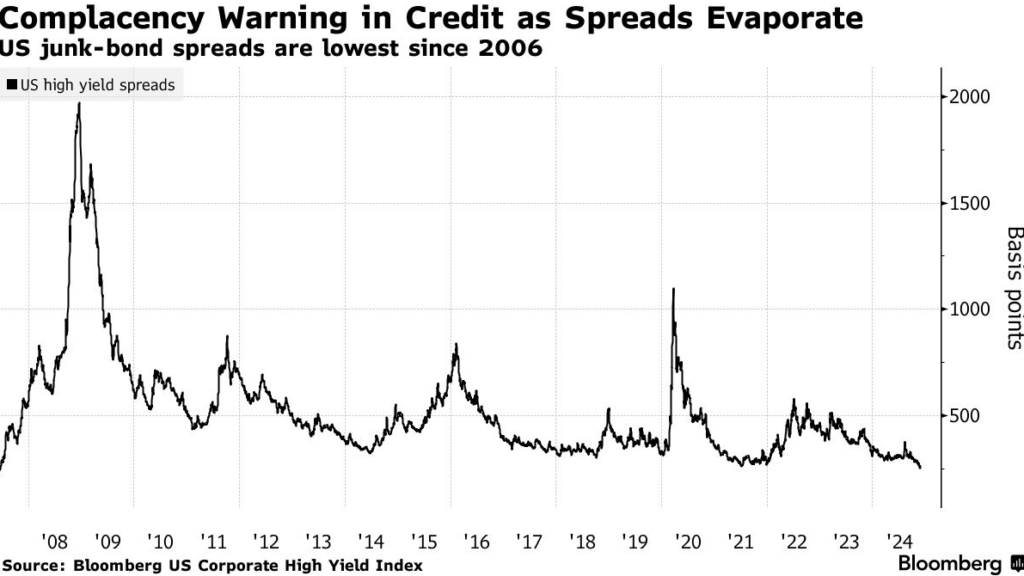

- Credit is so hot that traders are building shorts. Asset managers with money to spend and few new deals to buy have pushed credit spreads to near all-time tights as the global economy remains strong. That signals some that it’s time to buy downside protection. Bloomberg

Charts we are watching

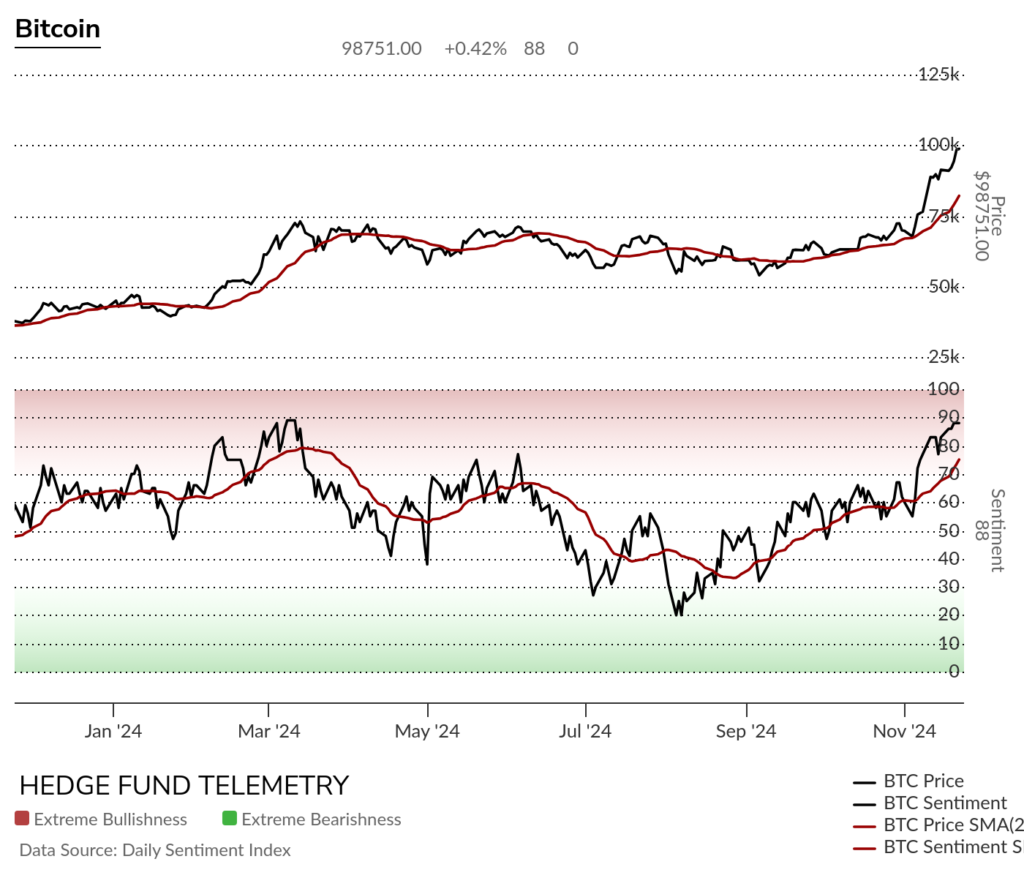

Bitcoin and other crypto have been red hot with as a Trump trade. I am not a crypto investor but I post this chart each day on First Call which has had a DeMark Sequential in progress from 69k. There are new sell Countdowwn 13’s in play so a pullback is probable. If this got really ugly there are DeMark Absolute Retracement targets at 61k and 49k. Recall in the Summer I mentioned the downside wave 5 price objective of 50k which was achieved when the yen carry trade blew up. (yellow line).

Bitcoin weekly nearly hit 100k which it still could move above but wanted to point out the upside wave 5 price objective has been achieved. This is a mechanical price target that often can be useful. RSI is overbought so if you’re a Bitcoin investor you might get a chance to buy a dip.

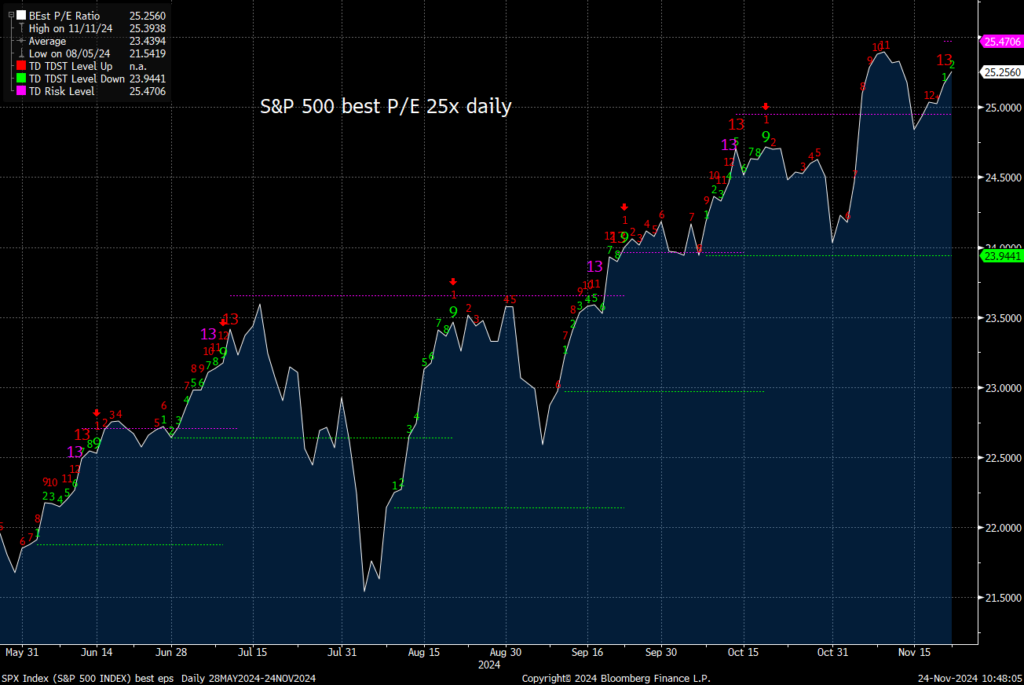

I know valuations don’t matter in this market but the S&P best P/E is at 25x spiking after the election. Running the DeMark indicators on the P/E has worked well ahead of pullbacks and stalling out periods. There’s a new Sequential sell Countdown 13 in play.

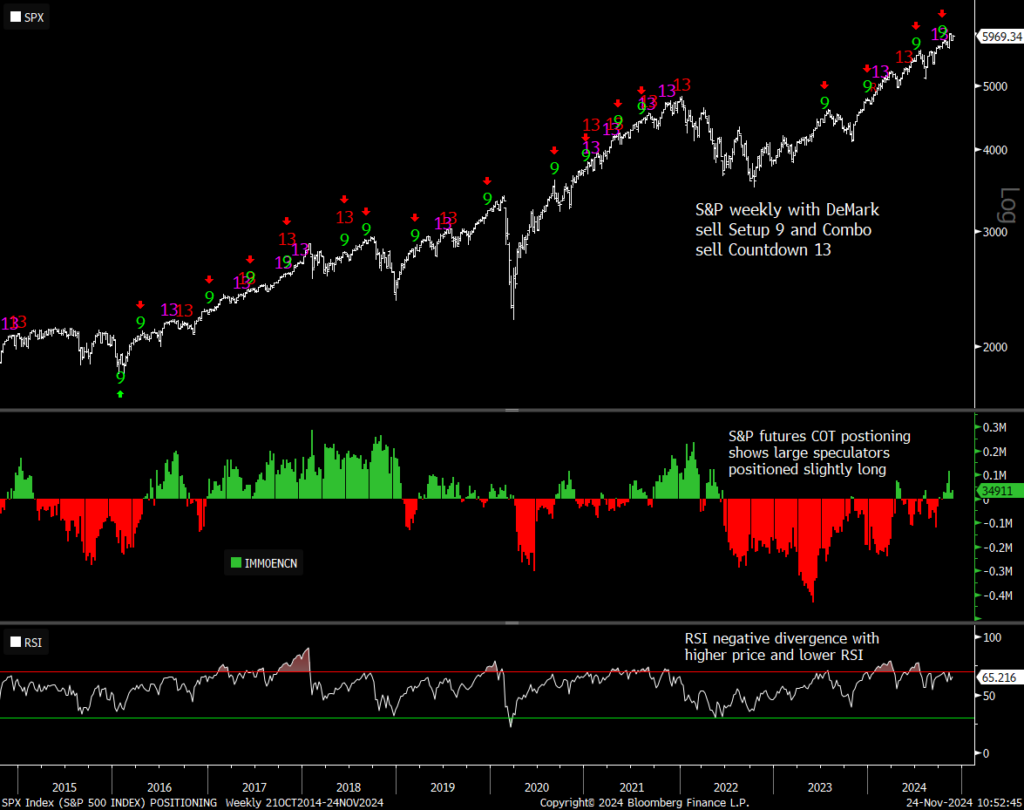

S&P weekly still has the DeMark Combo and sell Setup 9 in play while the RSI negatively diverges. COT large speculator long positioning has moderated.

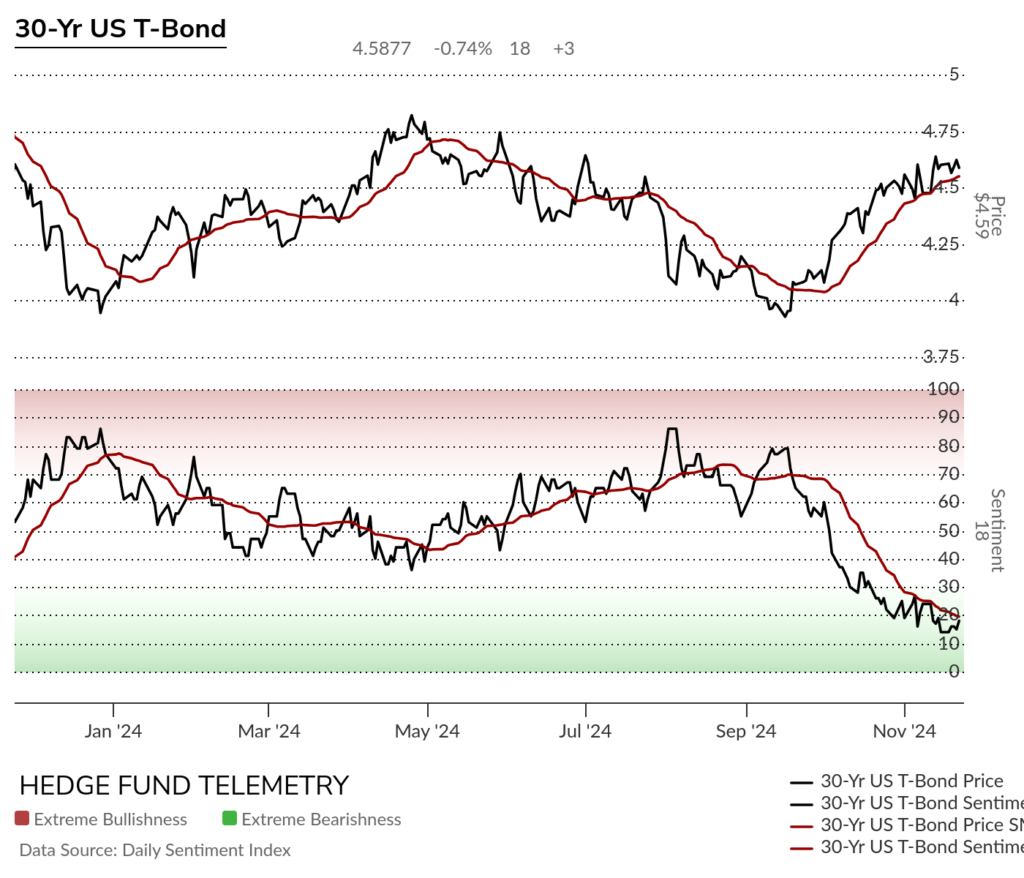

Back in September I talked often about the DeMark signals that were going contrary to what people were expected which was rates to continue to decline with the Fed cutting rates. The call was pretty good with rates moving significantly higher (and sentiment dropping from overbought to now oversold). I believe rates can and might still move higher but a pullback with rates and a bond bounce is possible and why I am now long bonds. I’ve thought this would correlate with an equity pullback which is yet to occur.

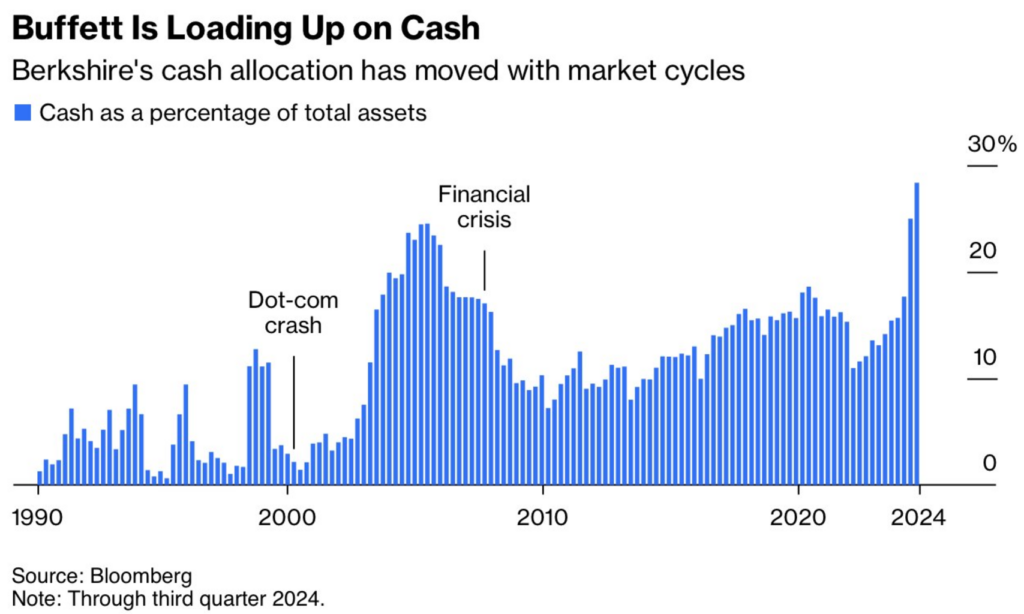

Warren Buffett has continued selling stakes in Apple and Bank of America and even stopped buying back Berkshire stock. This is a good chart showing how he raised a percentage of cash ahead of significant market tops. Even better, when he starts deploying that cash, it’s correlated with markets moving higher.

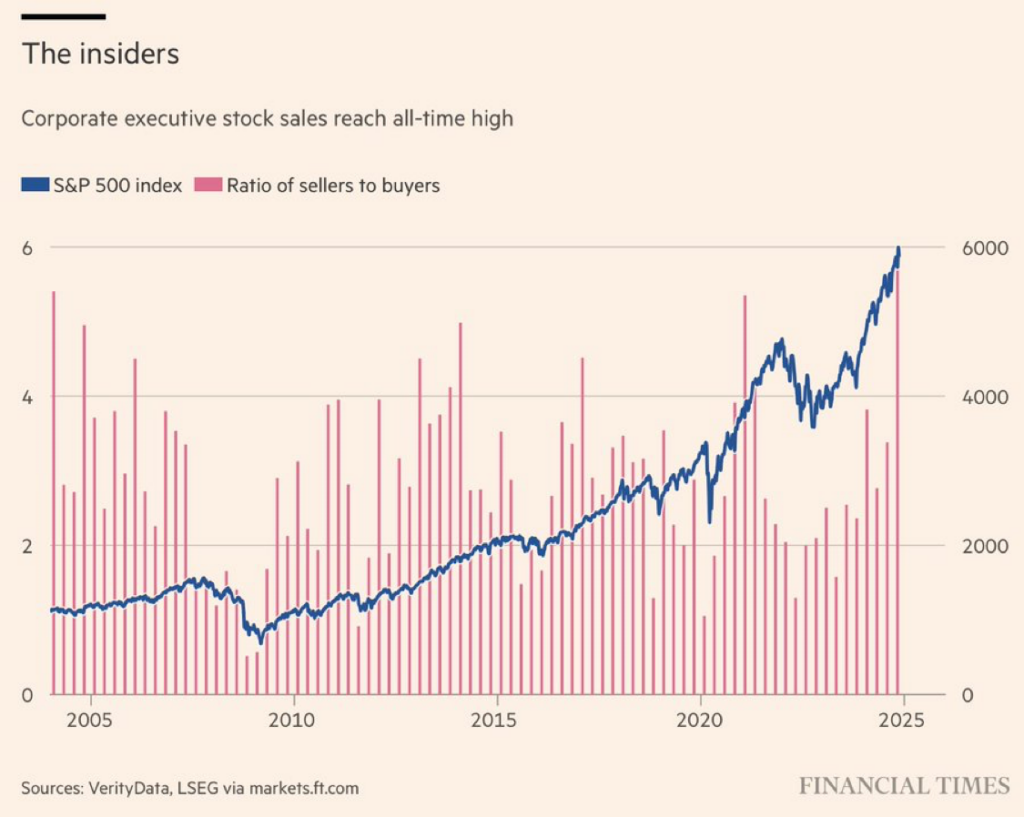

Corporate insiders ratio of sellers to buyers hit an all time high.

Credit spreads are at the lowest level since 2006. I’ll post the investment grade and high yields spreads this week. This tends to be a better indicator for me vs using the VIX Index.

US economic data for the week

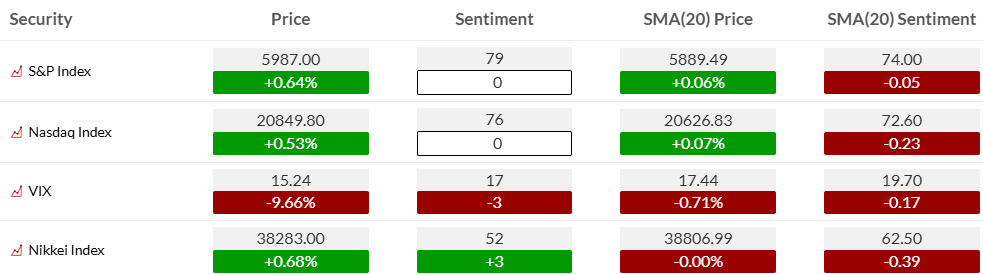

KEY MARKET SENTIMENT

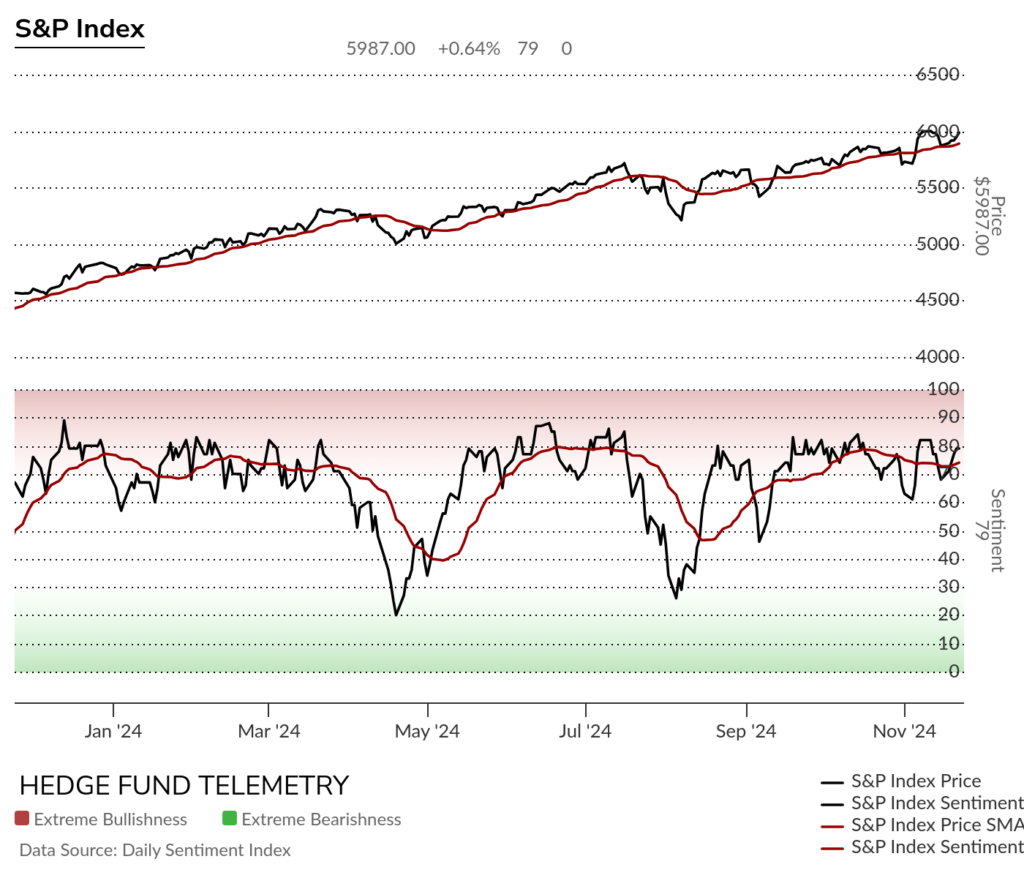

Equity bullish sentiment was unchanged on Friday holding in the upper end of the elevated zone.

S&P and Nasdaq bullish sentiment

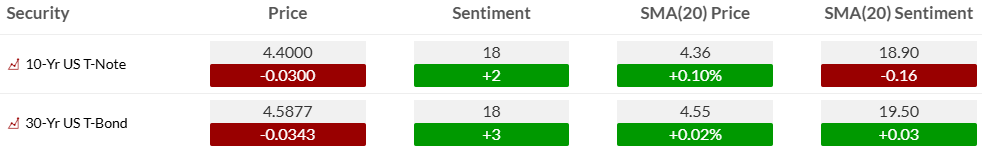

Bond bullish sentiment with a slight uptick on Friday.

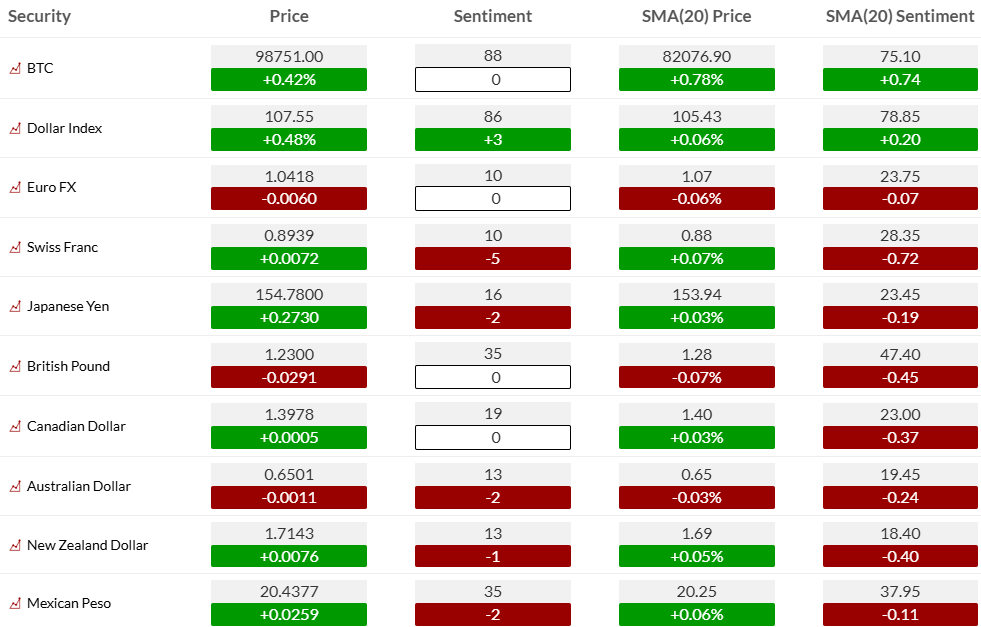

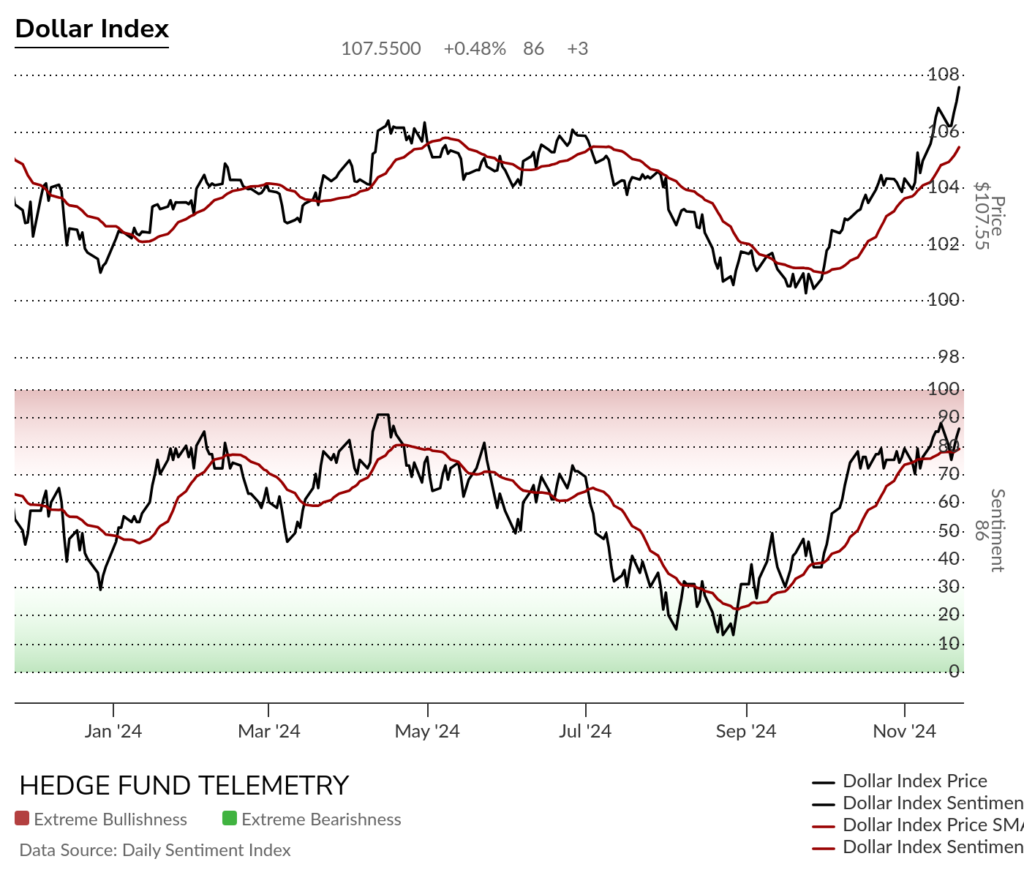

Currency bullish sentiment with US Dollar bullish sentiment remaining in the extreme zone. Bitcoin also is at historically extreme levels.

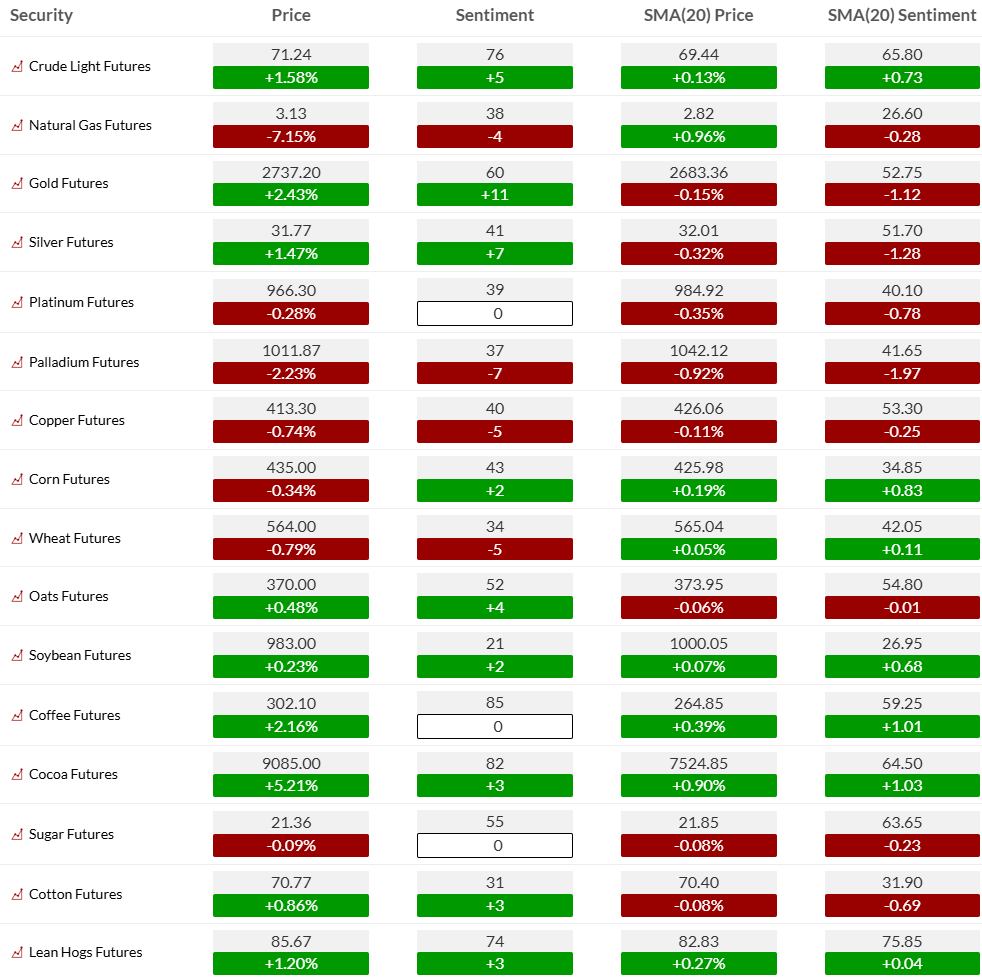

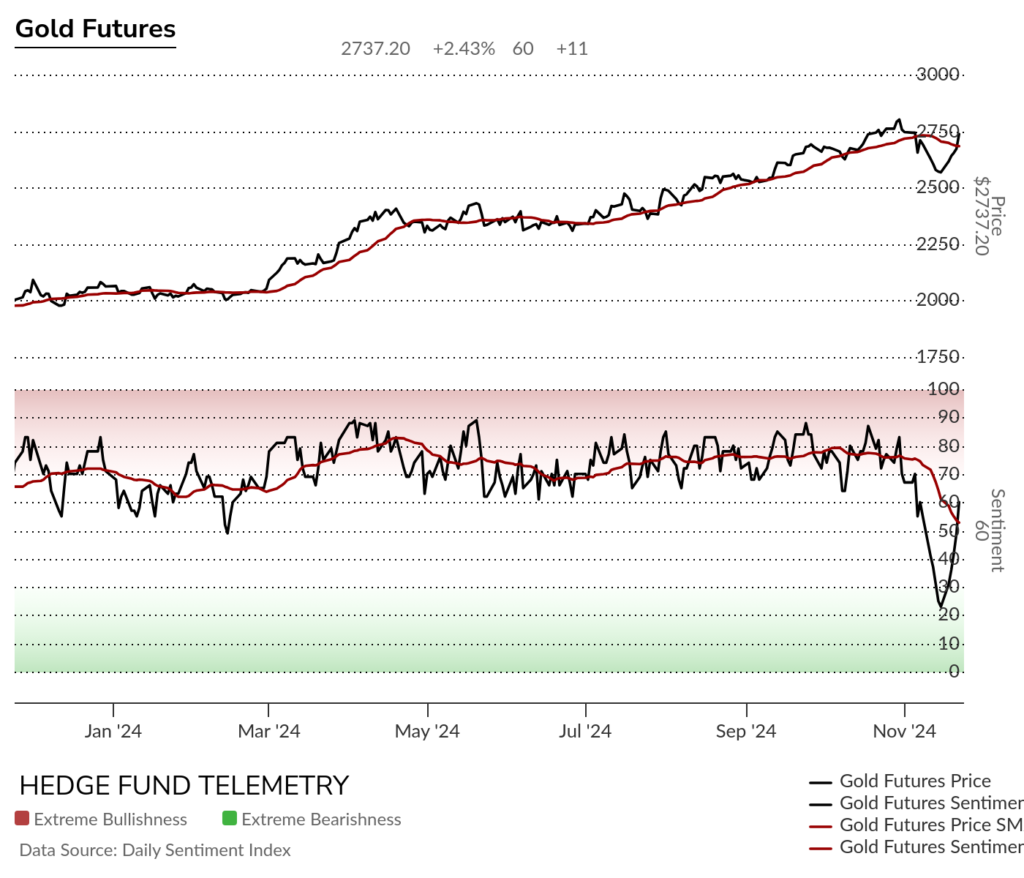

Commodity bullish sentiment was mixed on Friday with Gold with another strong upside day. I think we timed the long entry well.

Gold sentiment held the ~60% level for over a year and I believed if and when it broke it would be a deeper pullback from what has been happening in the past year. It gave an opening to buy on the low.

EARNINGS, CONFERENCES, AND ECONOMIC REPORTS

- Monday 25-Nov:

- Corporate:

- Earnings:

- Pre-open: ALAR, BBWI, CRGO, DSX, GASS, NIPG, UXIN

- Post-close: A, API, BLBD, CENT, FLNC, LESL, LX, NJR, PFLT, PNNT, SMTC, TBBB, WWD, ZM

- Analyst/Investor Events: PAR

- Brokerage Conference:

- Elara India Conference

- BofA European Credit Conference

- Needham Consumer Tech and Ecommerce Virtual Conference

- BTIG Digital Health Forum

- 121 Mining Investment Conference

- National Bank Financial CEO Mining Conference

- Jefferies Kuwait Corporate Day

- TD Securities Technology Conference

- Macquarie Global Energy Transition & Commodities Virtual Conference

- German Equity Forum

- Berenberg 1×1 Symposium at the German Equity Forum

- Yuanta Securities Corporate Day

- Goldman Sachs India Corporate Conference

- Earnings:

- Economic

- Europe: PPI y/y, IFO Business Climate

- Asia: CPI NSA Y/Y

- Corporate:

- Tuesday 26-Nov:

- Corporate:

- Earnings:

- Pre-open: ADI, AMWD, ANF, BBY, BURL, CCG, DKS, EMBC, ICCM, KSS, M, MDWD, SJM, TEN, TITN, UCL

- Post-close: ADSK, AMBA, ARWR, CRWD, DELL, GES, HPQ, HTHT, IREN, JWN, NOAH, NTNX, PD, PNST, URBN, WDAY, YXT, YY

- Analyst/Investor Events: n/a

- Brokerage Conference:

- 121 Mining Investment Conference

- National Bank Financial CEO Mining Conference

- Jefferies Kuwait Corporate Day

- TD Securities Technology Conference

- Macquarie Global Energy Transition & Commodities Virtual Conference

- German Equity Forum

- Berenberg 1×1 Symposium at the German Equity Forum

- Yuanta Securities Corporate Day

- Goldman Sachs India Corporate Conference

- DNB Nordic Healthcare Conference

- Goodbody Equity Conference

- Furey Research Partners Hidden Gems Conference

- Automic Markets Investment Conference

- Earnings:

- Economic

- US: FHFA House Price Index, New Home Sales, Consumer Confidence, Redbook Chain Store, API Crude Inventories

- Europe: PPI y/y

- Asia: Manufacturing Production NSA Y/Y

- Corporate:

- Wednesday 27-Nov:

- Corporate:

- Earnings:

- Pre-open: ARBE, CLGN, FRO, QSG, XYF, YI

- Analyst/Investor Events: RGLD

- Brokerage Conference:

- German Equity Forum

- Berenberg 1×1 Symposium at the German Equity Forum

- Yuanta Securities Corporate Day

- Goldman Sachs India Corporate Conference

- Automic Markets Investment Conference

- Societe Generale Premium Review Conference

- Danske Bank Winter Seminar

- Jefferies Australia Melbourne Corporate Summit

- Earnings:

- Economic

- US: Weekly Initial Jobless Claims, MBA Mortgage Purchase Applications, Durable Orders, GDP, Personal Income, Wholesale Inventories, Core PCE, Pending Home Sales, Personal Spending, DOE Crude Inventories

- Europe: GfK Consumer Confidence, Consumer Confidence

- Corporate:

- Thursday 28-Nov: US Markets Closed

- Corporate:

- Brokerage Conference:

- Societe Generale Premium Review Conference

- Danske Bank Winter Seminar

- Jefferies Australia Melbourne Corporate Summit

- Carnegie Small & Mid Cap Seminar

- Bernstein Premium Review Conference

- J P Morgan Midcap Conference (India)

- PDUFA: APLT (govorestat)

- Brokerage Conference:

- Economic

- US: Weekly Continuing Jobless Claims, EIA Natural Gas Inventories, FOMC Minutes

- Canada: Current Account

- Europe: Trade Balance, Retail Sales y/y, Preliminary CPI y/y, Business Confidence, Consumer Confidence, M3 Money Supply y/y, PPI y/y, Economic Sentiment Indicator, CPI y/y, Retail sales y/y, PPI m/m

- Asia: Industrial Production m/m, Unemployment Rate, CPI Tokyo y/y, Industrial Production m/m (preliminary), Retail Sales y/y, Retail Sales m/m

- Corporate:

- Friday 29-Nov: US Markets Close 1PM ET

- Corporate:

- Brokerage Conference:

- J P Morgan Midcap Conference

- PDUFA: Acoramidis, ZYME (zanidatamab)

- Brokerage Conference:

- Economic

- US: Chicago PMI

- Canada: GDP Chain Price, GDP, GDP m/m

- Europe: PPI y/y, Core Retail Sales m/m, Final GDP y/y, Retail Sales y/y, Unemployment Rate, Nationwide House Price Index y/y, Consumer Goods Spending m/m, PPI m/m, Preliminary CPI y/y, Final GDP q/q, KOF Leading Indicator, GDP y/y, Retail Sales, BoE Mortgage Approvals, M4 MoneySupply m/m, Unemployment rate, Flash CPI y/y, Preliminary GDP (second) y/y

- Asia: Housing Starts y/y, Non Manufacturing PMI y/y, official Manufacturing PMI y/y

- Corporate:

Thanks to Street Account, Vital Knowledge, and Bloomberg as valued sources.