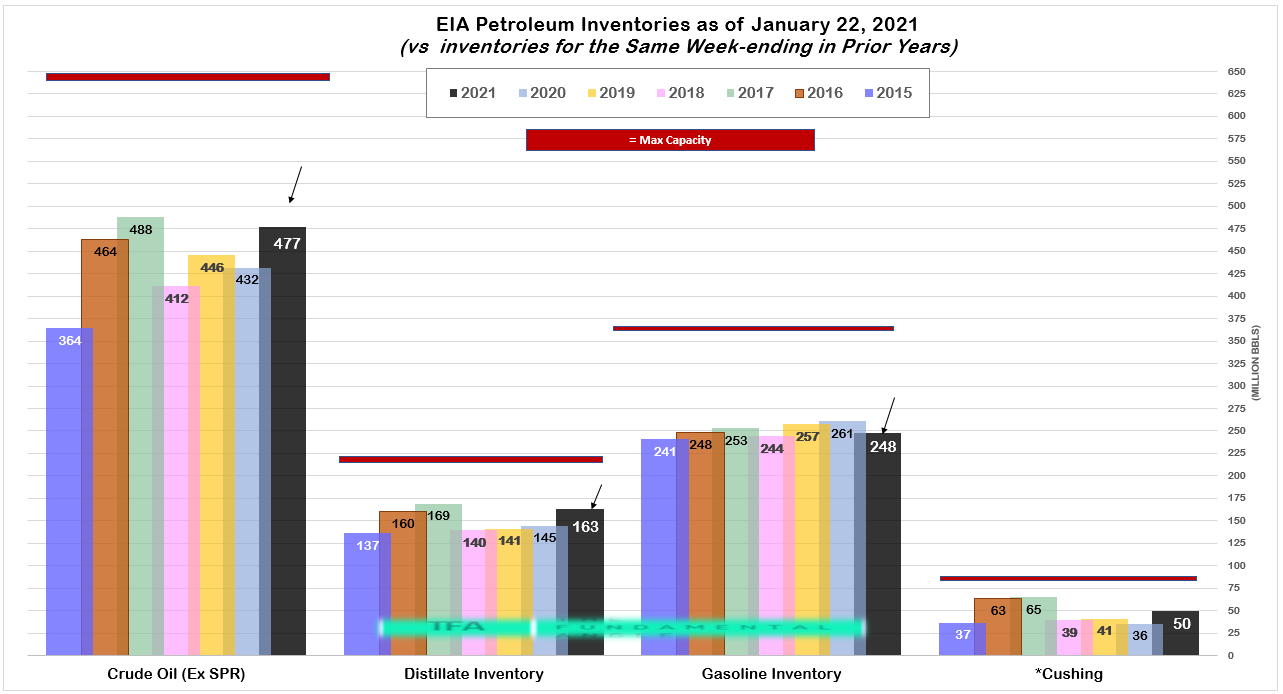

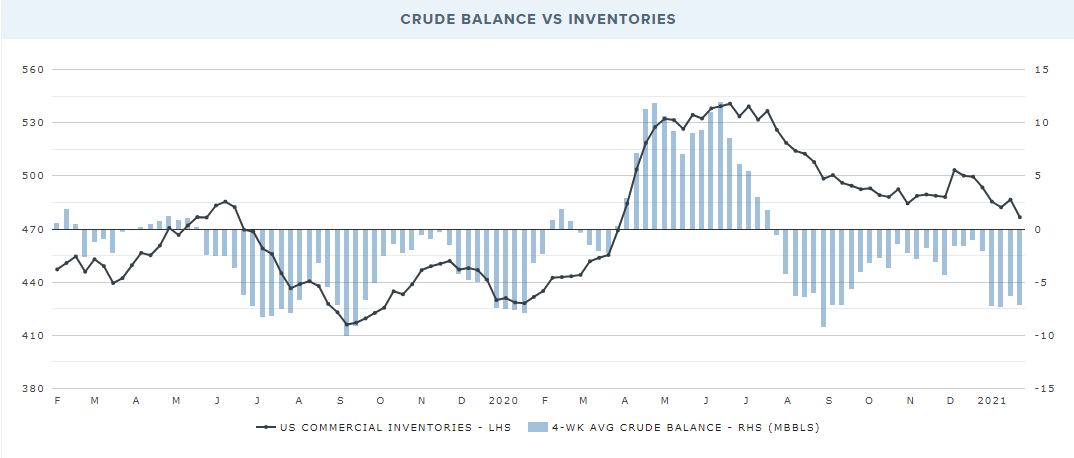

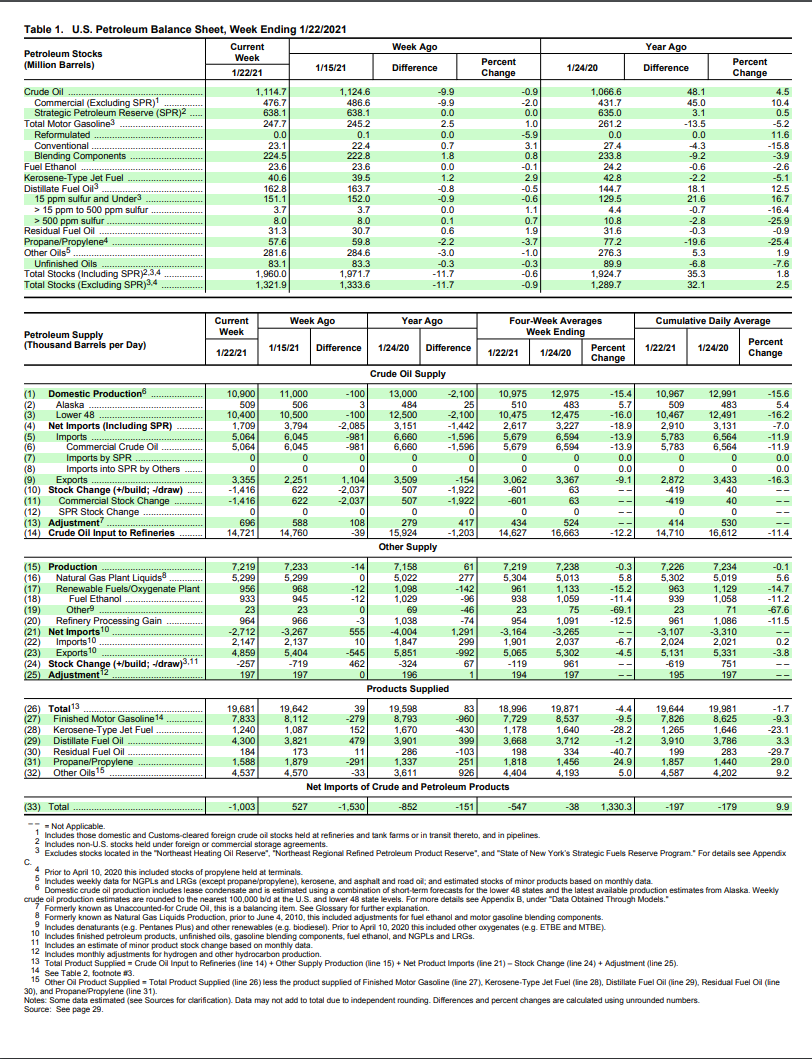

Crude: -9.910M

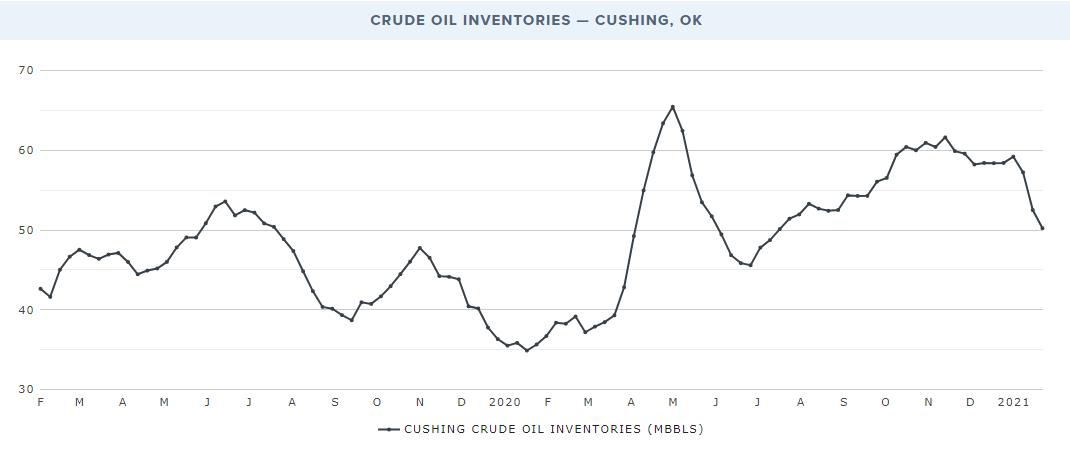

Cushing: -2.281M

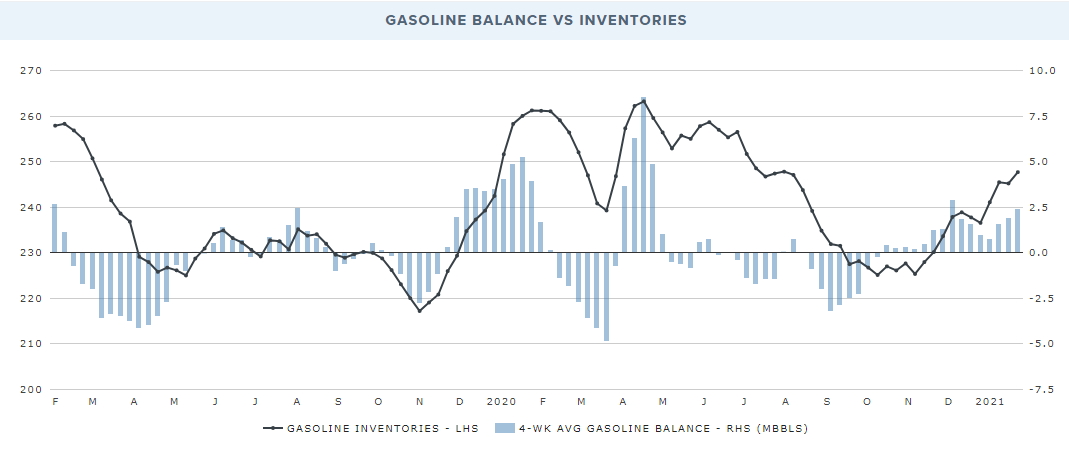

Gasoline: 2.470M

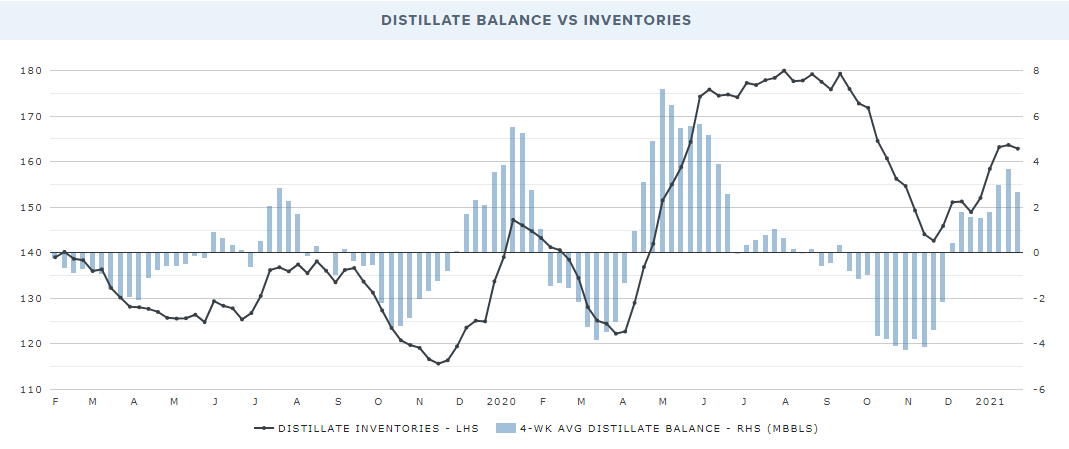

Distillates: -0.815M

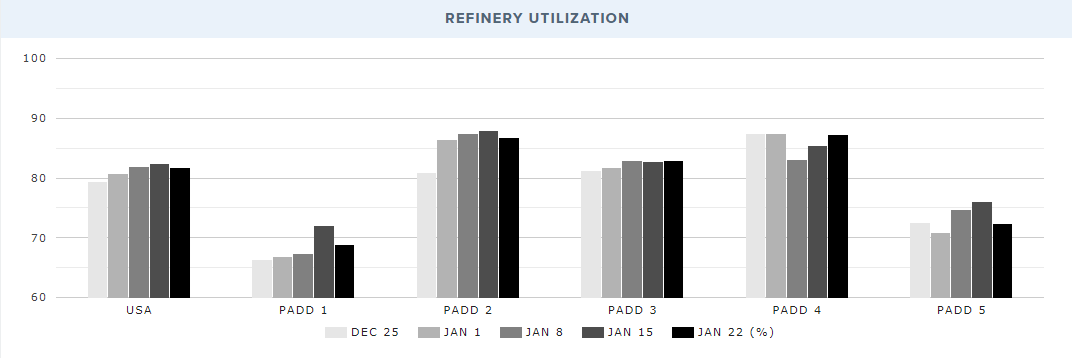

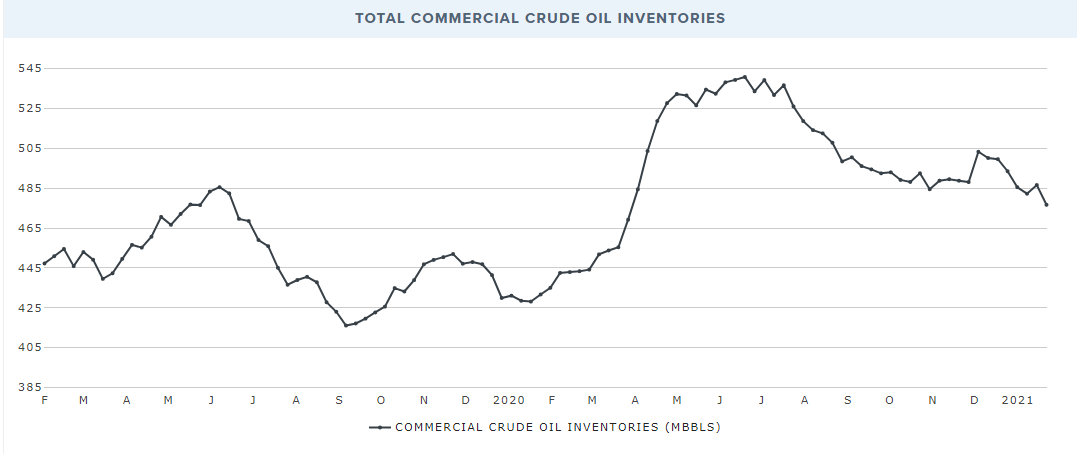

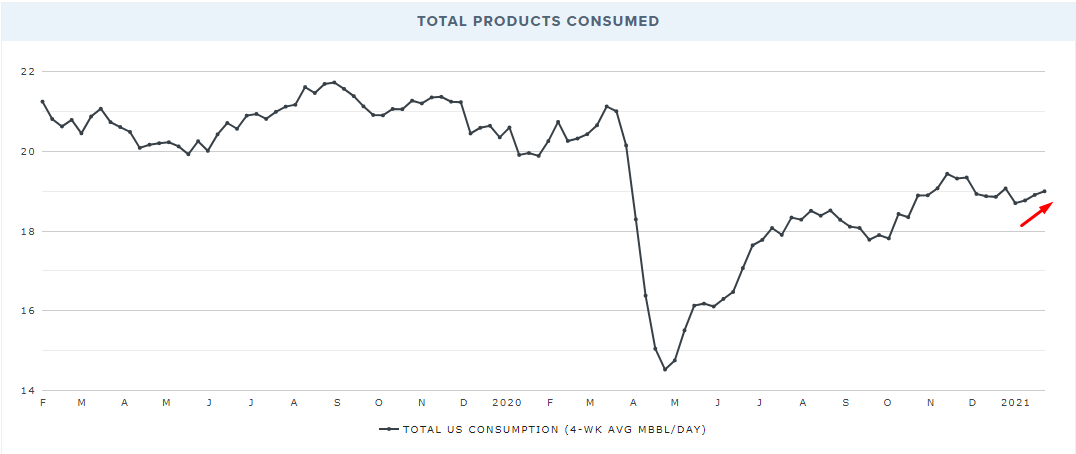

Fantastic report this week. This current draw puts us at just 5% above the 5-year average, we have been around 8-11%. Imports were down 1M bpd and exports were up almost 1M bpd. We had another solid Cushing draw. Refinery utilization was 81.7%, about 1/2 a percent down from last week, but still over 80%, which is strong, given the time of year and demand situation. States are starting to open up again, gyms, schools, museums, etc, which should be strong for domestic gasoline demand in the weeks ahead. Another propane draw, though not quite as large, but still solid at -2.2M. That distillate draw, though small, puts us down only 1.2% from the same period last year. Gasoline, although a build puts us right in line this same period for the last 5 years. Total products supplied (or consumed) which is implied demand is up to 19 M bpd, the third week in a row for an increase, which changes the trend. This is positive for oil and oil equities, particularly refiners and NGL producers.

EIA PETROLEUM INVENTORIES VS INVENTORIES FOR THE SAME WEEK-ENDING IN PRIOR YEARS

REFINERY UTILIZATION

TOTAL COMMERCIAL CRUDE OIL INVENTORIES

CRUDE OIL INVENTORIES — CUSHING, OK

CRUDE BALANCE VS INVENTORIES

GASOLINE BALANCE VS INVENTORIES

DISTILLATE BALANCE VS INVENTORIES

TOTAL PRODUCTS CONSUMED

EIA

U.S. crude oil refinery inputs averaged 14.7 million barrels per day during the week ending

January 22, 2021 which was 39,000 barrels per day less than the previous week’s average.

Refineries operated at 81.7% of their operable capacity last week. Gasoline production decreased

last week, averaging 8.7 million barrels per day. Distillate fuel production decreased last week,

averaging 4.5 million barrels per day.

U.S. crude oil imports averaged 5.1 million barrels per day last week, which decreased by 1.0 million

barrels per day from the previous week. Over the past four weeks, crude oil imports averaged

about 5.7 million barrels per day, 13.9% less than the same four-week period last year. Total

motor gasoline imports (including both finished gasoline and gasoline blending components) last

week averaged 465,000 barrels per day, and distillate fuel imports averaged 474,000 barrels per

day.

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve)

decreased by 9.9 million barrels from the previous week. At 476.7 million barrels, U.S. crude oil

inventories are about 5% above the five year average for this time of year. Total motor gasoline

inventories increased by 2.5 million barrels last week and are about 3% below the five-year

average for this time of year. Finished gasoline and blending components inventories both

increased last week. Distillate fuel inventories decreased by 0.8 million barrels last week and are

about 8% above the five-year average for this time of year. Propane/propylene inventories

decreased by 2.2 million barrels last week and are about 9% below the five-year average for this

time of year. Total commercial petroleum inventories decreased by 11.7 million barrels last

week.

Total products supplied over the last four-week period averaged 19.0 million barrels a day, down

by 4.4% from the same period last year. Over the past four weeks, motor gasoline product

supplied averaged 7.7 million barrels a day, down by 9.5% from the same period last year.

Distillate fuel product supplied averaged 3.7 million barrels a day over the past four weeks,

down by 1.2% from the same period last year. Jet fuel product supplied was down 28.2%

compared with the same four-week period last year.

FULL REPORT HERE